All Features articles – Page 21

-

Features

FeaturesLong term matters: It’s corporate tax, stupid

Bill Clinton used the slogan “It’s the economy, stupid” to help him win the 1992 US presidential election. The same now applies to corporate tax in 2021.

-

Features

FeaturesPrivate credit: Floating to safety

Despite inflationary headwinds, the outlook for private credit remains strong

-

Features

FeaturesPrivate credit fundraising: A record year for private-debt funds

Record amounts of capital were raised by private-debt funds in 2020 but the outlook may be less strong in the short term

-

Features

FeaturesESG & private markets: Crying out for standards

Growing awareness of ESG is fuelling pressure for definitive metrics to assess company performance

-

Features

FeaturesFixed Income, Rates, Currencies: Trickier than usual

Amongst the myriad of investment conundrums facing investors, one of the more pressing today is whether – or not – the US economy will overheat. Though the Federal Reserve has done a good job assuring the markets that while (US) inflation data may indeed print higher than “target”, Chair Jerome Powell will be “looking through” any rises. They have argued that these should be temporary and a dovish outlook will remain.

-

Features

Research: Stewardship is key to the ‘S’ pillar

Simon Klein and Amin Rajan show the reliance of social-related passive funds on equities

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - June 2021

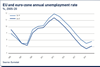

The UK experience with vaccination suggests that COVID-19 case numbers start falling when about half the population is immunised. The US will soon reach that level. The EU is over the 30% mark while Japan is at 3%. Taking the BRIC countries as a proxy for emerging markets, Brazil scores 16%, while Russia and India have reached about 10%. China has not published its vaccination figures. Meanwhile, new strains remain a source of concern.

-

Features

Accounting: Getting there eventually

You could be forgiven for thinking that audit reform has a lot in common with online shopping: knowing what you want is the easy part – it is fulfilment that is the let-down.

-

Features

Pensions insider: Handling mistrust after a huge loss

In the first in a series of articles aimed at empowering trustees, our expert contributor describes how a pension fund solved a real-life case involving poor judgement by a high-yield bond manager

-

Features

FeaturesAhead of the curve: Crypto assets

It is no longer prudent to ignore the potential of crypto assets

-

Features

Briefing: France decrees biodiversity reporting

France, having pioneered mandatory climate-risk reporting by investment firms, again breaks new ground by requiring biodiversity reporting in the same sector.

-

Features

FeaturesBriefing: China bonding with the world

It is tantalising to imagine the concept – that the standard global fixed-income portfolio, which has stood the test of time for so long, may be about to unravel. The standard bearers – US Treasuries, the UK Gilts, German Bunds and Japanese government bonds (JGBs) – may soon have to share the stage with a brash newcomer: Chinese government bonds (CGBs).

-

Features

Briefing: Credit-risk niche gains interest

In a world of prolonged low interest rates, institutional investors are scouring different pockets of the investment landscape to generate additional returns. One area is capital regulatory transactions, which are far from new but are being put under the microscope for their potential as part of an alternative credit portfolio. However, these transactions can be more complex than other alternative credit asset classes and require specialist expertise, skills and understanding.

-

Features

FeaturesLong term matters: Grandpa, what did you do in the COVID wars?

Pharmaceutical companies in the West and their host governments are very confident today, and some even speak of “post crisis investing”. Certainly, pharma’s scientific credentials have been demonstrated and the public in the UK and the US in particular are seeing the potential end to lockdowns.

-

Features

FeaturesFixed income, rates, currencies: Still missing the target

Most would agree that one data release from an important but volatile dataset – employment figures – should be read with caveats. However, the scale of the forecasting ‘miss’ for April’s US job numbers was hard to dismiss as just noise.

-

Features

FeaturesESG: Society first, profits second

Asoka Woehrmann and Amin Rajan ask whether social issues will become a permanent driver of investment decisions

-

Features

FeaturesStrategically speaking: Hayfin – no hayseed

Europe’s abortive football super league didn’t collapse from want of loan capital this April. It collapsed, instead, because of a catastrophic lack of cultural fit with the ethos of the sport.

-

Features

FeaturesPerspective: Nicolai Tangen & NBIM

Less than a year after his controversial appointment, criticism of Nicolai Tangen’s leadership of Norges Bank Investment Management is building