All Features articles – Page 16

-

Features

FeaturesQontigo Riskwatch – March 2022

* Data as of 31 January 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesIPE Quest Expectations Indicator – March 2022

Political risk is back. Russian aggression towards Ukraine inserts considerable amounts of uncertainty. Asset owners will in general not suffer significant direct consequences for a well-diversified portfolio, but there are potential implications for energy prices that come at a time when inflation was already making a comeback and on top of unexpected military expenditure when budgets are already charged by COVID-19-related outlays

-

-

Features

FeaturesAccounting: DB sponsors at a crossroads

If a decade ago the talk was of defined-benefit (DB) scheme sponsors locked in an infernal struggle against the dizzying gravity of spiralling accounting deficits, thoughts now are turning to the end game.

-

Features

FeaturesAhead of the curve – Late-stage growth: a growing priority in PE portfolios

With additional options to fund growth outside of an initial public offering (IPO), start-ups are staying private longer. The average age at which venture capital-backed companies go public has increased from about 4.5 years during the 1990s to about 6.5 years today.

-

Features

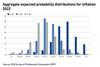

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

Features

Case study – SPH: How to embed behavioural insights in managing a pension fund

In the Netherlands, pension reforms are slowly picking up steam. Long overdue and in many respects a sensible direction, pension boards can choose between variants that redistribute investment risk between individual participants and the collective pension scheme.

-

Features

FeaturesBriefing: High yield off to a rough start to the year

High yield did not have a good start to the year. Rising inflation and a more hawkish central bank tone in the US and UK triggered panic selling in January. However, as the dust settles and bad news is priced in, the asset class looks more appealing than other fixed-income segments. Easy pickings may be gone, though, and opportunities will have to be selected carefully.

-

Features

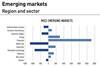

FeaturesBriefing: Now is not the time to give up on emerging markets

“Just when I thought I was out, they pull me back in!” This classic Al Pacino line has applied to many emerging market investors in recent years. Like Michael Corleone, drawn by the potential offered by bold business opportunities, they have accepted to take higher levels of risks in a quest to obtain better results. However, similarly to the family at the heart of The Godfather saga, the outcome of such bets has often caused a lot of pain.

-

Features

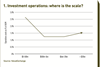

FeaturesStrategically speaking – WTW: Democratising private markets

WTW’s ill-fated merger with Aon, announced at the outset of the pandemic in early March 2020, would have shaken up the corporate insurance brokerage market. It would also have created an outsourced CIO (OCIO) giant to compete with Mercer in terms of delegated assets under management (AUM).

-

Features

FeaturesPerspective – Liability-driven investing: DIY LDI

A multi-decade trend of falling interest rates, the increased complexity of financial markets and the growing burden of regulation have conspired to turn pension provision into an extremely sophisticated activity. This is especially true for defined benefit pension funds, which may be facing a gradual decline in number, but remain a key source of retirement income.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2022

Wait and see

Omicron surprised a world that thought COVID was almost over. Infections shot up in the EU, UK and US, reaching all-time highs, especially in France. However, while absolute levels remain high, the curves have turned and panic is abating. Death rates were little affected. -

Features

Accounting: IASB’s sustainability challenges

Thinking back to 2007, pensions was the spectre at just about every feast when it came to the work of the International Accounting Standards Board (IASB), not least because of the push to persuade the US to adopt International Financial Reporting Standards (IFRS).

-

Features

FeaturesAhead of the curve: The rise of altcoins and potential institutional adoption

It is interesting to sit between traditional investors and the crypto-native communities: one has just started on the Bitcoin adoption curve while the other might already consider Bitcoin to be a ‘boomer coin’.

-

Features

FeaturesJoseph Mariathasan: Avoiding ‘tragedy of the horizon’

Climate change is the “tragedy of the horizon”, warned Mark Carney, then governor of the Bank of England, in a 2015 speech to the insurance market Lloyd’s of London.

-

Features

Briefing – ESG data: material innovations

As environmental, social and governance (ESG) considerations have risen in importance among investors in recent years, so the subject of data quality has become an essential issue.

-

Features

FeaturesResearch: Operational challenges for investors

A new study on operational and informational efficiency highlights the challenges for smaller funds

-

Features

FeaturesFixed income, rates, currencies: COVID starts to lose grip on GDP

COVID’s huge influence on all our lives, whether through disruption of global supply chains or threats of lockdowns in the face of soaring infection rates, was reasonably constant throughout 2021. However, it now appears that GDP numbers have become generally less sensitive to COVID infection rates than they were, say, 18 months ago, with high vaccination rates (certainly across developed markets), and an awareness from politicians that the public’s willingness to comply with lockdowns may be waning fast.