All Features articles – Page 12

-

-

Features

FeaturesAhead of the curve: Beefing up guardrails as risks rise in private credit

For US and European private credit firms, storm clouds are gathering.The recent rate hikes by the Federal Reserve, European Central Bank (ECB) and the Bank of England (BoE)have numbed activity in the leveraged loan and high-yield spaces.

-

Features

FeaturesThe dynamic feature of SFDR: ‘walking the walk’ benchmarks

Forward-looking information is in high demand among those aiming to invest sustainably. Forward-looking planning of one’s decarbonisation does not mean actually moving forward at the envisioned pace though, unless the penalties for trailing pace are in place and sufficiently painful.

-

Features

FeaturesThe rising influence of target-date funds on capital markets

One of the fastest growing markets in recent years is the US retirement market. Since 1995, the investment volume has increased six-fold, so that by the end of 2021, the market stood for almost $40trn (€40.1trn) AUM.

-

Features

FeaturesUK sovereign debt in turbulent waters as challenges remain

The buttoned-up Gilts market has never seen or done anything like it. Trusty stalwart of liability matching for defined benefit (DB) pension schemes, the blue-chip security has already poleaxed a British chancellor of the exchequer just a month in office, and has effectively done the same to prime minister Liz Truss.

-

Features

FeaturesFixed income, rates & currency: The return of extreme volatility

The emergency measures swiftly enacted by policymakers and central banks in March 2020, as we locked our communities, schools and businesses down, unsurprisingly created huge volatility in financial markets.

-

Features

FeaturesDistributed work: a novel solution for displaced workers

What COVID has taught the world so dramatically is that knowledge-based companies have been able to function effectively with all their employees working remotely. Location suddenly no longer matters, and many employees have taken advantage of lockdowns to cross borders and work in places they wanted to be in, whether holiday resorts or with family.

-

Features

FeaturesSingle versus double materiality: ISSB faces inconvenient truths

Climate change denial has been a tough ask this summer. Forest fires raged across Europe, part of a London suburb caught light, and hurricane-force winds left a trail of destruction in southern Austria. The doom loop was complete when falling river levels left France’s nuclear power plants battling to produce enough energy to meet the demand for cooling.

-

Features

FeaturesUK LDI woes raise wider European questions

Turmoil in UK Gilt markets has forced continental European pension industries to review their risk management strategies

-

Features

FeaturesPension funds on the record: how they manage LDI

Pension funds reflect on the role of LDI in their portfolios and the risks associated with an unlikely, but not impossible, sudden rise in interest rates

-

Features

FeaturesQontigo Riskwatch - October 2022

*Data as of 31 August 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesFixed income, rates & currency: Central banks act tough

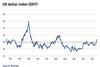

This year’s Jackson Hole Symposium, an annual high-level event sponsored by the Reserve Bank of Kansas, yielded relatively little policy news. But the fighting talk from the US Federal Reserve and others was striking. Fed chair Jerome Powell’s speech was markedly more hawkish than expected, while Isabel Schnabel, board member of the European Central Bank, referred to the need for central banks to act ‘forcefully’ because “both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high”.

-

Features

FeaturesAhead of the curve: Clearing up the ‘scaling’ confusion in carbon intensity

Today, a company’s carbon intensity is typically measured in one of two ways – scaling by revenue, or by EVIC (enterprise value including cash). The choice an investor makes can lead to differences in portfolio characteristics.

-

Features

FeaturesLGIM’s Michelle Scrimgeour: ambitions for growth

Michelle Scrimgeour and her executive team set out their strategic growth priorities in November 2020, a little more than a year after she had taken over as CEO of Legal & General Investment Management (LGIM). They agreed to grow the business by focusing on existing strengths: to modernise, diversify and to internationalise.

-

Features

FeaturesIASB's management commentary project faces identity crisis

Any regular follower of the International Accounting Standards Board is probably familiar with a particular recurring nightmare. It starts with good intentions but spirals into shifting project goals, missed targets, and unquantifiable hours of wasted time. Perhaps you awoke during July to find yourself observing the board’s July discussion of its management commentary project.

-

Features

FeaturesIPE Quest Expectations Indicator: monthly commentary

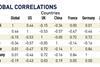

Political risk has decreased. An attack in the north-east of Ukraine took the Russian army by surprise but did not cause collateral damage in Russia. Russians’ resistance to the war is mounting but far from a critical level. It looks like the EU will survive the winter without major energy disruption and caps on energy prices are falling into place.

-

Features

FeaturesPension funds continue their focus on ESG social issues

Before the year is over, European policymakers are expected to announce their decision to shelve plans for a social taxonomy.

-

Features

FeaturesMarket overview: German institutional investors manage uncertainty

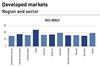

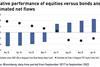

At mid-year 2022, the volume of Spezialfonds – the German vehicle for professional investors – administered on Universal Investment’s platform was €498bn, a rise of around 5% year on year. On a six-month basis, however, and compared with the end of the booming stock year 2021, asset volumes were down around 3%.

-

Features

FeaturesCan a sinking market re-emerge?

Travelling around Sri Lanka in mid-July reminded me of Winston Churchill’s saying that “democracy is the worst form of government – except for all the others that have been tried”. Many in Sri Lanka would argue that the post-independence history of the country may have proved him wrong. This year, political upheavals after popular demonstrations caused the administration of President Gotabaya Rajapaksa and his elder brother, Prime Minster Mahinda Rajapaksa, to collapse after the Rajapaksas’ deep corruption and deeper ineptitude over two decades brought economic ruin as the country ran out of foreign exchange to pay for fuel imports.