All Features articles – Page 10

-

Features

FeaturesPrivate equity fundamentals resilient in headwinds

The economy and markets are beset with headwinds, and private equity assets are unlikely to be impervious. The concerns with the asset class are wide-ranging, from difficult financing conditions to rising interest rates, squeezed corporate margins and closed exit routes.

-

Features

FeaturesTCFD reporting for pension funds in the UK: a progress report

Some 18 months from the introduction of mandatory reporting of climate data by large UK pension funds, evidence shows that the policy has not brought about greater orientation towards green investments

-

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

-

Features

FeaturesPensionsEurope: Not all doom and gloom for 2022

After the bumper investment returns of 2021 – the best that many pension funds had ever experienced – last year’s results were disappointing.

-

Features

FeaturesIPE Quest Expectations Indicator: February 2023

Russian attacks against Ukrainian civilians are hampered by efficient air defence. With weapons for the Ukrainian military on the way, a new offensive seems imminent. US President Joe Biden’s troubles over classified documents are a relief for Republicans. The threat of a US-EU trade conflict over China is growing as both sides retreat into nationalistic behaviour. In the UK, Conservatives are under threat of predicted historic losses, while Prime Minister Rishi Sunak so far has done nothing to repair relations with the EU.

-

-

Features

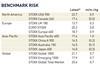

FeaturesQontigo Riskwatch - February 2023

*Data as of 30 December 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesAccounting: Happy birthday to the ISSB

The International Sustainability Standards Board (ISSB) finds itself at a crossroads as it marks its first anniversary. On the one hand, it is redeliberating its first two sustainability standards and could finalise and issue them during the first half of this year.

-

Features

FeaturesWill the US pushback against ESG slow global progress?

Hostility towards asset managers embracing climate action and stewardship is raising questions on both sides of the Atlantic

-

Features

FeaturesAhead of the curve: Time to automate collateral management

The resilience of financial markets has been tested several times in recent years, from the so-called ‘dash for cash’ at the start of the coronavirus pandemic in March 2020 to the spike in UK Gilt yields in September 2022.

-

Features

FeaturesResearch: Thematic investing is set to attract fresh capital

In the second article on the new Amundi-Create Research survey, Vincent Mortier and Amin Rajan highlight pension plans’ interest in thematic investing

-

Features

FeaturesDid smart beta go ‘horribly wrong’?

In 2016, we published a paper titled ‘How can ‘smart beta’ go horribly wrong?’, the first in a series on the future of factor investing and other forms of so-called smart beta. Did smart beta go horribly wrong? Yes and no.

-

Features

FeaturesHigh yield bonds: do your homework

Last year, European bond markets were struck by a toxic a combination of geopolitical, economic and market tensions. The picture has improved with the dawning of 2023, although the markets will continue to experience bouts of volatility and uncertainty will persist. High yield is back on the agenda, but selectivity and careful analysis will be key in identifying the right opportunities.

-

Features

FeaturesFresh views on emerging markets

Despite a large, heterogeneous universe of opportunities across countries that have little or no commonality, risk contagion in the emerging market universe is still an issue, highlighted most dramatically by the 1997 Asian crisis and the risk on/risk off capital movements after the 2007-08 global financial crisis.

-

Features

FeaturesIs the US heading for a soft landing?

Rare though they are in history, a soft landing for the US economy seems to be the consensus forecast, a view aided by news of a sharp contraction in the Institute of Supply Management (ISM) Services Purchasing Managers index in December. The jobs market also looks like it is slowing down and there are signs of a cooling off in wages, with lower-than-expected average hourly earnings reported in December’s non-farm payroll report.

-

Features

FeaturesIPE Quest Expectations Indicator - January 2023

Better air defence and the ground freezing over are steadily improving the outlook for Ukraine’s forces, now locked in stalemate. A series of blunders haunts US Republicans in general and Trump in particular. If Biden’s stimulus package is enacted, it will counteract Fed policy, possibly prolonging the series of interest rate increases. The EU seems to have bought too much gas. It has agreed to take border measures against some products from climate change laggard countries.

-

-

Features

FeaturesQontigo Riskwatch - January 2023

*Data as of 30 November 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesAccounting: Long-haul climate change reporting

Shortly after the International Sustainability Standards Board (ISSB) tentatively confirmed that companies using its climate-reporting standard must disclose their Scope 3 greenhouse gas (GHG) emissions, board chair Emmanuel Faber took to Twitter, making the bold claim that the board was “rewriting economics”.

-

Features

FeaturesAhead of the curve: Is small cap the next mean reversion trade?

By now, most investors have noticed a rebound in value relative to growth in equity markets. After underperforming growth over the past decade, value stocks are experiencing strong mean reversion and outperforming significantly.