All Features articles – Page 6

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Features

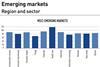

FeaturesQontigo Riskwatch – November 2023

*Data as of 29 September 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator - November 2023

IPE’s monthly poll of market sentiment, asking 50 asset managers about their six to 12-month views on regional equities, global bonds and currency pairs

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Features

FeaturesPricing the decline of democracy for investors

History does not progress in a linear way. Science, democracy, technology, arts, the economy and any other type of evolutive process advance and recede in chaotic movements, even though they ineluctably move towards progress. Those recessions and pull-backs often go unnoticed at first, at least to the casual observer. And yet, they end up profoundly sanctioned by all stakeholders including the economy, financial markets and investors.

-

Features

FeaturesRegulators set sight on private market fund valuations

The current waves of rising inflation and interest rates, economic uncertainty and market volatility may eventually be remembered as just a temporary setback for managers of unlisted assets. But the regulatory initiatives announced in recent months, following pressure from investors and the public, could bring about deeper changes to the buoyant private markets industry.

-

Features

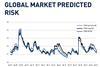

FeaturesMarket volatility: low risk does not mean ‘no risk’

Efforts to produce an accurate estimate of market risk can sometimes turn into a pessimist’s paradise, leading to a paradox. If the outcome of the estimation looks positive, investors might feel that they should not count on it, and if it looks negative, the real outcome will probably be worse than expected. From that perspective, the third quarter of this year was a very unusual one, quantitatively speaking. Not only did both risk and return decline simultaneously – a rare event – but investor sentiment also turned negative during the quarter, ending at its lowest level since the March banking crisis.

-

Features

FeaturesInversion anxiety: what’s up with yield curves in 2023

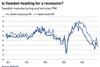

For over half a century, each time the spread between US 10-year and three-month yields turned negative, indicating an inverted yield curve, a recession followed, sooner or later. In 2023, the yield curve has been more than just a little inverted.

-

Features

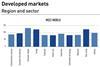

FeaturesQontigo Riskwatch - October 2023

*Data as of 31 August 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator - October 2023

The Russian war in the Ukraine is still stalling, with the prelude of the US elections coming closer. Trump’s self-destructive utterings keep his followers unmoved but do nothing to convince independents.

-

Features

SASB grapples with universal appeal

In the ever-evolving landscape of corporate sustainability, the Sustainability Accounting Standards Board (SASB) has long been the guiding star for the 90% or so of companies in the S&P500 that use the standards to chronicle their environmental, social and governance journey.

-

Features

FeaturesResearch: Pension funds stabilise EU financial markets in good times and bad

A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017

-

Features

FeaturesImpact investment: How change theory can boost key messages

Simply aligning an investment with one of the UN Sustainable Development Goals (SDGs) does not always convince individuals about the impact of an investment. Communicating about change can help.

-

Features

FeaturesDutch suggestions for fine-tuning pension funds’ climate stress tests

Five Dutch IORPs supplemented EIOPA’s 2022 stress test, the first to include climate scenarios, with their own more granular approach

-

Features

FeaturesCredit investors ready for a possible US recession

Although 2023 has been ‘interesting’ so far, it has also provided relief after the challenges and financial asset mayhem of 2022, and a wide range of asset classes have posted positive returns to date.

-

Features

FeaturesFixed income, rates & currency: Lean times to follow good summer?

The macro-economic news in the third quarter has been good, with better growth than expected and better inflation data than feared. In the final few months of the year, however, markets may have to deal with the potential for some softer economic news and possibly more negative inflation data, and not just from seasonal factors.

-

Features

FeaturesHow the AT1 bond market shrugged off the Credit Suisse debacle

On a late Monday evening in August, the Italian right-wing government unexpectedly announced a new 40% tax on banks’ ‘windfall’ profits derived by the higher lending rates. Shares in Italian banks tumbled, banking executives cried foul, and analysts poured scorn over the measure. The government, which was hoping to raise up to €3bn to help families and small businesses, backtracked shortly after, scaling back the tax.

-

Features

FeaturesQontigo Riskwatch - September 2023

*Data as of 31 July 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants