All Features articles – Page 9

-

Features

FeaturesJapan: New hand on the tiller

Kazuo Ueda, is the first new governor of the Bank of Japan (BoJ) in 10 years. One of outgoing governor Haruhiko Kuroda’s last moves was to widen the yield curve control (YCC) band on 10-year bonds from +/-25bps to +/-50bps. The reaction from the bond market over the following few days was to trade to the new upper limit.

-

Features

FeaturesIPE Quest Expectations Indicator April 2023

With new, superior equipment, the Ukrainian military is set to start an offensive soon. Meanwhile, Yevgeny Prigozhin, leader of the Wagner Group, is jockeying to become Russia’s next kleptocrat on the back of the Russian army. Donald Trump’s candidacy is increasingly beleaguered by defeats in court. The trade agreement on Northern Ireland between the EU and the UK is a significant boon for both as well as for Prime Minister Rishi Sunak, not because the trade flows are so important but because the issue blocked co-operation in many other fields. While the winter has been mild and beneficial, there are early signs of a dry spring, quite possible in view of climate change setting in. If that materialises, harvests, therefore food prices, will be affected in autumn.

-

Features

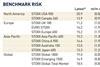

FeaturesQontigo Riskwatch – April 2023

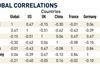

*Data as of 28 February 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesAccounting: IFRS’s Kono says no

On the face of it, the staff at the International Sustainability Standards Board (ISSB) have done a good job so far.

-

Features

FeaturesAhead of the curve: Introducing the concept of a carbon risk-free curve

As global investors and companies progress towards their net-zero emissions targets, the concept of a carbon risk-free curve becomes increasingly relevant within the fixed-income market. In our view, this curve should provide a reference for evaluating the risk levels of bonds in relation to their issuers’ CO₂-equivalent (CO₂e) emissions and can therefore help investors to assess the impact of changes in CO₂e emissions on the yield spread of fixed-income bonds.

-

Features

FeaturesUkraine: The mother of all impact investments

Institutional investors can play a crucial role in rebuilding Ukraine in a post-war future

-

Features

FeaturesThe West should understand the strengths and limitations of Enterprise China

China is fast becoming the West’s bogeyman. Yet a hard decoupling of the two would be a lose-lose situation for both. Despite the tensions, private companies face the challenge of creating viable strategies for interactions with China that could make the difference between success and bankruptcy.

-

Features

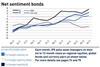

FeaturesFixed income, rates & currency: Optimism fades on mixed data

January’s market optimism has been subsiding, as forecasts for inflation and US Federal Reserve policy shift the outlook further to the hawkish side. However, the macro picture is not clear. Markets hang on to every new piece of data to clarify the outlook, be it non-farm payrolls, the consumer price index (CPI) or the US Job Openings and Labor Turnover Survey (JOLTS).

-

Features

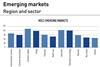

FeaturesEmerging markets decarbonisation

The International Energy Agency estimates that developing economies and emerging markets are responsible for more than two-thirds of global carbon emissions.

-

Features

FeaturesUS: SECURE 2.0 means the hard work ahead for pension plan sponsors

On one thing pretty much everyone agrees: the new SECURE 2.0 Act is very broad, complex, and will create a lot of work for US plan sponsors and retirement providers. In fact, the Setting Every Community Up for Retirement Enhancement law includes over 90 different provisions.

-

Features

FeaturesQontigo Riskwatch – March 2023

*Data as of 31 January 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

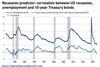

FeaturesIPE Quest Expectations Indicator March 2023

The next Ukrainian offensive will be in April at the earliest, as modern tanks will have arrived by then. US Republican pushback of ESG and climate-related investments are a new bone of contention in relations with the EU, already strained by the Trump presidency, and a bad sign for US-EU co-operation on China policy, an issue Japan seems to be ducking successfully. Aided by a soft winter, EU energy concerns have become quite manageable.

-

Features

FeaturesAccounting: The line between transparency and confidentiality

It was inevitable that the push by the International Sustainability Standards Board (ISSB) to redefine non-financial reporting would collide with the question of just how much transparency is too much. We had something of an answer on 18 January when the board explored disclosures about the risks and opportunities that arise from climate change.

-

Features

FeaturesAhead of the curve: The missing elements in the digital currencies debate

The recent contraction of the cryptocurrency markets poses questions about the viability of digital currency as an asset class for institutional investors. However, these developments have not undermined the efforts of central banks to pursue their own digital currency initiatives.

-

Features

FeaturesResearch: How pension funds look at Chinese assets

Allocations to Chinese assets are still modest. Vincent Mortier and Amin Rajan discuss key issues in the third and final article from the latest Amundi-Create-Research Survey

-

Features

FeaturesAustralia: Regulator targets greenwashing

Vanguard, one of the world’s largest investment managers, suffered the indignity in December of being the second company in Australia to receive an infringement notice for alleged greenwashing.

-

Features

FeaturesCentral banks and the weaponisation of finance

The US has been a global power since the second world war. But it was during the interval between the collapse of the USSR in 1991 and the rise of China in the 21st century that the US was perhaps the single global hegemon.

-

Features

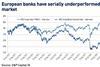

FeaturesFear and loathing in European banks

Any CEO would recognise there is a problem when investors do not want to put their money to work with you. That is the situation that European banks find themselves in. The MSCI Europe bank index has considerably underperformed its MSCI Europe parent over the last 10 years.