All Features articles – Page 14

-

Features

FeaturesA broader view on corporate pension disclosures

What is not to like? Finally, a principles-based approach to the disclosures in financial statements that aims to cut the clutter and home in on the material that is truly material.

-

Features

FeaturesChina calls the tune for emerging markets

If President Xi Jinping mismanages China, the careers of many emerging market asset managers could be over. It would also mean emerging markets as an asset class would become irrelevant, at least according to Xavier Hovasse, head of emerging markets at the French fund management house Carmignac, who has devoted his career to seeking opportunities in emerging markets.

-

Features

FeaturesSeeking clarity as stakeholders shine a light on ESG ratings

There is confusion about the objectives of ESG ratings and any regulation needs to be clear about what it is trying to achieve and for whom

-

Features

FeaturesA flawed EU crypto regulatory framework

The EU will soon have a specific regulatory framework for crypto currencies and markets. Under proposals soon to be adopted, only crypto coins authorised in the EU will be allowed to be offered to investors. But crypto assets and exchanges will have a very light supervisory regime, much less than what is in place for financial instruments and exchanges. This raises the question about the rationale for distinct rules. This question is even more acute in the context of the big decline in the crypto markets over the past weeks.

-

Features

FeaturesThe Dutch pension sector needs to explain why we need to move to a new system

The Dutch pension system has been recognised for many years as one of the best in the world. According to the Global Pension Index of Mercer and CFA Institute, the Netherlands has the best pension system after Iceland.

-

Features

FeaturesImportant role for securities services firms in ESG metrics

The focus on environment, social and governance (ESG) or sustainability investing is almost always on the front office. Fund flows, strategies and research have been centre stage. Often forgotten are the asset-servicing firms working in the wings developing solutions to help their clients evaluate, validate and comply with rules and regulations, particularly in Europe.

-

Features

FeaturesIPE-Quest Expectations Indicator commentary June 2022

The longer Russia refuses to make concessions, the more it loses, both in territory and in ‘face’. The Russian army has suffered even more loss of face than the Russian government. Analysts believe Europe and the UK now run the most risk. Perhaps, but in a post-war environment, they stand to gain most from reconstruction works in the Ukraine as well as the energy transition speeding up at home.

-

Features

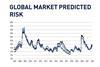

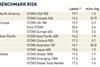

FeaturesQontigo Riskwatch - June 2022

* Data as of 29 April 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesEmissions reporting: taking stock of indirect emissions in Scope 3

Disclosure proposals by the US Securities and Exchange Commission (SEC) in March could guide the regulatory searchlight beyond companies’ direct and indirect C02 emissions (Scope 1 and 2) and towards upstream and downstream (Scope 3) emissions.

-

Features

FeaturesAccounting: IASB risks project duplication over sustainability

Looking back, the warning signs were clear. “The trustees of the IFRS Foundation are considering whether [we] should play a role in the development of sustainability reporting standards,” the March 2021 exposure draft explains.

-

Features

FeaturesAhead of the curve: tie executive pay to climate targets

AllianzGI and Cevian Capital take very different approaches to how we manage equity portfolios, but we are both long-term and active owners of companies. Following a series of conversations about how to best implement ESG criteria in our portfolios, we have found a common perspective.

-

Features

FeaturesAI could help triple Europe’s private debt market

Investors seeking higher yield have driven the growth of the private debt market. European private debt, though still much smaller than the US market, has also been growing rapidly. European lenders managed assets of $350bn as of June last year, according to Preqin, in a total market of $1.19trn. This is more than double the level in December 2016.

-

Features

FeaturesResearch: beyond the net-zero hype

The exact path to a net zero world is unknown but the direction of travel is clear, argues Amin Rajan

-

Features

FeaturesUK venture: new kids on the block

Google the venture firm 2150 and you won’t find an investment strategy but a manifesto.

-

Features

FeaturesFixed income, rates & currency: disappearing safe havens

Risk markets have been having a torrid time of late. ‘Risk-free’ government bond markets are not providing any safe havens in these storms, with curves steepening and considerable volatility in longer rates.

-

Features

FeaturesUK DB schemes in a risk transfer sweet spot

Pension funds are in a good position for buyouts, but is there enough capacity in the market and will DB superfunds provide a genuine alternative?

-

Features

FeaturesYen’s swift dive surprises market

For several decades, the Japanese yen has not been in the limelight too often. However, earlier this year it became headline news as the currency began to depreciate rapidly against the US dollar. Although investors were not overly surprised that the yen would weaken, the speed of its decline was certainly startling. Over the course of about 15 months, between the start of 2021 to early April 2022, the yen has lost about 25% of its value against the dollar, with nearly half the move occurring in that final month.

-

Features

FeaturesQontigo Riskwatch - May 2022

* Data as of 31 March 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-