All Features articles – Page 11

-

Features

FeaturesEuropean Commission announcement brings some clarity to derivatives clearing

Many unanswered questions linger after the departure of the United Kingdom from the European Union. However, a recent announcement by the European Commission (EC) promises to bring some much-needed clarity to the derivatives market.

-

Features

FeaturesClimate risks – pay now or later?

Climate change is an emergency that requires all hands on deck. What should be the role of investors when it is governments that have the most power to effect change?

-

Features

FeaturesFixed income, rates & currency: Inflation strengthens its grip

Whereas news of the hostilities in Ukraine may be losing their potential to shock and dislocate the world economic order, inflation news has maintained its powerful hold over financial markets across the world throughout 2022, with many economies recording their highest inflation levels for decades.

-

Features

FeaturesPension funds at risk from cyber security threats

Regulators are increasingly focusing on the vulnerabilities of pension funds to the threat of cyber attack, which can bring disruption and potentially large-scale reputational fallout for schemes and sponsors

-

Features

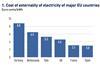

FeaturesESG: Germany’s energy options

The country’s reliance on Russian gas means its change of energy sources will carry a larger environmental cost

-

Features

FeaturesResearch: Pension investing in an inflation fuelled world

Monica Defend and Amin Rajan highlight the big upheavals facing pension investors

-

Features

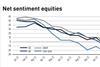

FeaturesIPE Quest Expectations Indicator: December 2022

The Ukrainian offensives look to have petered out and a new initiative will be needed to maintain morale. The US government is once again gridlocked and another debt ceiling fight is likely. The EU seems ready even for a harsh winter, but there are signs of war fatigue. In the UK, Prime Minister Rishi Sunak has apparently learned from the Liz Truss debacle, quickly making the necessary political U-turns, in particular on climate change. Expectations for the COP27 meeting in Sharm El-Sheikh were low. Analyst views indicate increasing belief that the wave of interest rate increases is receding.

-

Features

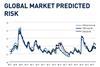

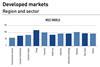

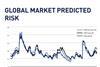

FeaturesQontigo Riskwatch - December 2022

*Data as of 31 October 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesAccounting: IASB risks annoying stakeholders

If nothing else, the appointment of Linda Mezon-Hutter to the International Accounting Standards Board promises to bring a much-needed breath of fresh air and dose of reality to the standard-setter’s sleepy proceedings.

-

Features

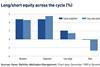

FeaturesAhead of the curve: Recalibrating alternative allocations for a new market

Geopolitics, inflation, and central bank policy have agitated financial markets in 2022, leaving returns and diversification in short supply. A comparison of global equities and bonds provides a sense of just how challenging the results have been.

-

Features

FeaturesHow SFDR became the impact benchmark star

Impact is often defined by intentionality and additionality.

-

Features

FeaturesEuropean pension dashboard in the starting blocks

The European Tracking Service for pensions has been years in the making but is now set for a rollout, to be completed by 2027

-

Features

FeaturesSustainable tourism: consumers need direction

The end of COVID lockdowns in most places has led to a boom in tourism in 2022 and a return to normality that should persist. Before the COVID pandemic, tourism accounted for around 10% of global GDP and 8% of global greenhouse gas (GHG) emissions, according to speakers at the Reset Sustainably conference on sustainable tourism held in London in September. The size of the industry means that moving towards more sustainable development can have a significant, positive impact on the world, both in terms of climate change and in the protection of natural resources, including biodiversity.

-

Features

FeaturesFixed income, rates & currency: Recessions - but when?

With the fourth consecutive 75bps hike in rates delivered in November, US Federal Reserve chair Jerome Powell suggested that the pace of the hikes might be slowed in the coming months (so slightly dovish), but then said that the terminal rate and how long it would be held was more important than the speed of tightening (back to hawkish). The initial dollar sell-off was unwound by the end of the press conference.

-

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.

-

Features

FeaturesUK fiduciary managers wrangle with LDI fallout

UK Gilt yields rose throughout 2022, even before September’s well-publicised spike caused by the unfunded mini budget. Fears of global inflation, exacerbated by the energy crisis and geopolitical uncertainty following Russia’s invasion of Ukraine, took UK 10-year yields from around 1% in January to 3% in mid-September.

-

Features

Features17Capital’s Pierre-Antoine de Selancy: Navigating NAV lending

Pierre-Antoine de Selancy has just left a meeting with his company’s new majority shareholder, Oaktree, and is running a little late. His days are busy. De Selancy is founder and managing partner of 17Capital, a London-based boutique specialised in providing NAV finance to private equity managers.

-

Features

FeaturesQontigo Riskwatch - November 2022

*Data as of 30 September 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

IPE Quest Expectations Indicator - November 2022

In general, political risk remained the same, except in the UK. The Russian offensive against Ukrainian civil infrastructure is useless. If it should succeed, Russia has no means to exploit it militarily. Ukraine is set to recover Kherson. In the EU, France is trying to cope with a vicious strike that blocks petrol deliveries, but its side effect is a push towards hybrid and non-petrol cars. Japan is worried over implicit North Korean nuclear threats. In the UK political risk has increased fast with a crisis caused by government tax plans that has sapped trust on several levels. The data indicate that analysts believe that the wave of interest rate increases is near (if not over) its top and that bonds are now becoming more attractive than equities for the first time in many years.