All Features articles – Page 7

-

-

Features

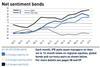

FeaturesIPE Quest Expectations Indicator: September 2023

US officials are talking up the Ukrainian advance towards Melitopol, a sign that all is not well. Contrary to expectations, the biggest problem is not the Russian air force, but land mines. Trump’s legal problems are as worrisome as his inexplicable lead among Republicans. US abstinence in the struggle against climate change is a potential cause for a major trade war as the EU realises it must expand its regulations on importing ‘dirty’ products to prevent a free rider problem undermining its climate efforts. In the UK, Labour’s lead over the Conservatives remains crushing, making it difficult to claim the government has a popular mandate.

-

Features

FeaturesResearch: The yin and yang of passive and active investing

Amin Rajan and Sebastian Schiele look at the complementary relationship between active and passive investment strategies

-

Features

FeaturesBritain’s LDI crisis: When things nearly fell apart

On 23 September 2022, Kwasi Kwarteng, the then UK chancellor of the exchequer, announced a £45bn (€52bn) package of tax cuts. The hand-outs, designed to please key voters, were the wrong gift at the wrong time. For several years, the Bank of England had been attempting to end quantitative easing and start putting a higher price on borrowing.

-

Features

FeaturesFossil fuel divestment is back in fashion

More and more asset owners are exiting oil and gas. Sophie Robinson-Tillett speaks to some about why, and how, they’re selling out of the sector

-

Features

FeaturesOpen-ended investment funds face up to the shadow banking dragnet

The debate over the systemic risk of non-bank financial institutions (NBFIs) – sometimes called shadow banks – is a recurrent theme but it has recently moved to the forefront thanks to tighter monetary policies, geopolitical risks and factors such as the UK’s LDI crisis. While regulators are assessing the threats posed, most market participants believe changes will not happen for years. For some, there are fears that largely unleveraged segments like open-ended investment funds could be unfairly targeted

-

Features

FeaturesThe US dollar’s declining status as a global reserve currency

The recent US debt ceiling negotiations have brought into question the viability of the US dollar’s status as a global reserve currency. Long-term investors have been reviewing their strategic asset allocation away from the currency, seeking to diversify their exposure and to take advantage of long-term investment opportunities.

-

Features

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.

-

Features

FeaturesISSB: Green future or more green washing?

Imagine a world where investment professionals can make decisions based on standardised environmental, social, and governance (ESG) data. Well, that may no longer be a pipedream, thanks in no small part to the publication on 26 June of the International Sustainability Standards Board’s (ISSB) board’s first two sustainability reporting standards.

-

Features

FeaturesPancakes for lunch with Nobel laureate Harry Markowitz

Harry Markowitz, Nobel Laureate and founder of Modern Portfolio Theory, passed away in June this year. Much has been written about his contribution to the development of modern finance theory. Less, though, on Harry as a person.

-

Features

FeaturesFX in waiting mode after lively 2022

After a long period of muted volatility, currency markets sprang back into action in 2022 as geopolitical risk and diverging monetary policy came to the fore. This year it is quieter, but markets remain rattled over the unpredictable interest rate scenarios. As a result, many market participants are waiting for a sharper picture to emerge.

-

Features

FeaturesIPE Quest Expectations Indicator: July 2023

The war in Ukraine is starting to look like a stalemate. This would be in Russia’s favour. Delivery to Ukraine of more of the tanks promised or fighters to contest Russian air control might lead to a breakthrough, but is unlikely to happen in the summer. In the US, Trump looks like a leading but weak candidate for the Republicans, even against a Democrat as unpopular as Biden. Legal pushbacks against the fight to prevent permanent climate change, notably in Texas, have the potential to cause a trade war with the EU. They illustrate how European and North American values are slowly drifting apart.

-

Features

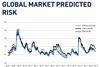

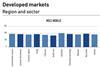

FeaturesQontigo Riskwatch – July 2023

*Data as of 31 May 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator: August 2023

Politics is on hold until September. Normally, markets do not care and analysts reduce their activity. A political crisis in the Netherlands shows the danger. There are warnings from all sides that climate measures are ever more urgently needed. Markets need a clearer view of which products govern- ments will support with market-shaping measures and when, especially in the face of a faltering pace towards climate goals. Early signs of problems include a lack of capital for innovative start-ups and the increasingly loud voices of climate change deniers.

-

Features

FeaturesAccounting: Corporate reporting at a crossroads

When the definitive history of modern corporate reporting is written, historians will no doubt step back in awe. They will marvel at the International Accounting Standards Board’s (IASB) decision to issue its management commentary proposals only to inherit the integrated reporting framework and then waste substantial energy grappling with the complexities of aligning or even merging the two.

-

Features

FeaturesAhead of the curve: Is growth back or is it a trap?

It is likely you have heard about ‘value traps’. They are low-multiple companies that are priced at an ever expanding discount to the market and structurally underperform as fundamentals weaken due to new competition and, in extreme scenarios, may even face obsolescence.

-

Features

FeaturesAustria’s politicians are too timid to make decisions, says VBV’s Schiendl

Austrian institutional investors believe that both national and European Union politics are impeding the evolution of the occupational pensions market.

-

Features

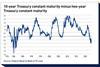

FeaturesFixed income, rates & currency: US debt crisis averted – what next?

The US debt ceiling crisis was resolved in June, avoiding potentially major fireworks, with a suspension of the limit until early 2025. This ensures that the next time the politicians have to fight about it will be after the November 2024 presidential election. Although markets were relieved at the temporary resolution, the process of rebuilding the very depleted Treasury cash balances – with some huge bill auctions planned – will drain significant liquidity from the system, which could put pressure on the rates market.

-

Features

FeaturesDigital health revolution ramps up

The world is at the beginning of a digital health revolution. This has been accelerated by the COVID pandemic that forced radical shifts in doctor/patient interactions, and supercharged by the emergence of OpenAI’s ChatGPT that brought generative artificial intelligence (AI) to the forefront and pulled the potential of AI in healthcare into the limelight.