All Features articles – Page 4

-

Features

FeaturesHow the EU's pay transparency directive affects pension sponsors

Pay transparency is looking set to be the employment hot topic of at least the next few years and reflects an ongoing global conversation around addressing equal pay. The latest figures in the EU put the gender pay gap at around 12.7% and the gender pension gap at in excess of 30%, with very little movement over the last few years. Greater transparency over pay is the route being adopted in a growing number of countries as the silver bullet to accelerate progress.

-

Features

FeaturesAnalysts push back on rate cuts

Federal Reserve chair Jerome Powell’s June press conference was, like most careful central bank-speak, open to interpretation. It was possibly slightly dovish with a hint of hawk. However, in the aftermath of the press conference, and following a few busy days of US economic data releases, many analysts have pushed back their forecasts for the number of interest rate cuts this year.

-

Features

FeaturesCyber catastrophe bonds make a debut as insurers offload risk

Cyber catastrophe bonds may be the new kid on the insurance-linked securities (ILS) block, but they have been talked about for years. The jury is out, though, as to whether they will follow the same trajectory as their natural cat bond peers. While some analysts believe they have the potential to go mainstream, others cite concerns over modelling and lack of diversification.

-

Features

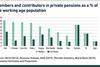

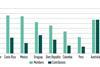

FeaturesReforms are needed to improve pensions in emerging markets

The emerging world is ageing the fastest. Despite having the advantage of a young population, emerging countries are expected to transition to older age groups within 25 years, a change that took over 150 years in some developed nations.

-

Features

FeaturesThe next Magnificent Sevens are hiding in plain sight

Like the so-called FANGs that preceded them, one could argue that the Magnificent Seven group of US tech mega-caps that accounted for a large portion of market performance in 2023 are now a part of Wall Street’s history books. Besides two names that have continued to pull away from the pack, the group is no longer commanding investors’ undivided attention.

-

Features

FeaturesT+1 settlement rules pose challenges for fund managers

A global move to compress settlement cycles – that is, the time between when a transaction is agreed and executed and when the transaction is completed and the securities and cash are exchanged – is underway. While the aim is to deliver lowered risk and cost savings, investors and market participants face challenges due to the increasingly interconnected nature of financial markets.

-

Features

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Features

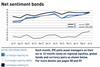

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Features

FeaturesWhy investors should focus on Scope 3 emissions

The investment industry is preoccupied with reducing Scope 1 and 2 emissions in portfolios to meet net-zero commitments. However, this focus will not provide a way to effectively manage climate transition and physical risk.

-

Features

FeaturesCorporate transition plans need to spell out net-zero dependencies

Corporate climate transition plans are gaining momentum globally. Essentially, these are reports about how a company plans to achieve emission reduction targets, but the idea is that the company will have engaged in strategic thinking and planning to produce such a plan, rather than just churn out more disclosures.

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Features

FeaturesPrivate credit secondaries come of age

Since the secondaries market came into existence, private equity has been the dominant asset class, but the tide is turning. It is finally time for private equity’s more youthful counterpart, private credit, to receive more of our attention. The private credit secondaries market borrows various elements from its older sibling, including best practices and deal structures, and it is now demanding the spotlight as awareness of the asset class increases.

-

Features

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Features

FeaturesUK creates social factors template for pension investors

Environmental and governance risks receive much attention, but UK and other European institutional investors have focused less on social factors and their complexities.

-

Features

FeaturesModelling shows net-zero investing can be profitable

Since the acceptance of the Paris Agreement in 2015, which bound nations to a legal commitment to reduce global temperatures, there has been a clear shift towards net-zero investing. While socially responsible investments are crucial for the mitigation of climate change, recent calls to row back on ESG funds suggest some hesitation.

-

Features

FeaturesIPE Quest Expectations Indicator - April 2024

The shadow of the US presidential elections is longer than normal because Trump is under several legal clouds. He could still get barred from participating but that seems unlikely. He does have a liquidity problem, a self-destructive streak, a mercurial character and no credible alternative waiting in the wings, though.

-

Features

FeaturesAn inflection point for India bonds

The impending inclusion of Indian government bonds (IGBs) in JP Morgan’s widely tracked $240bn (€220bn) Govern ment Bond Index-Emerging Markets (GBI-EM) index is seen as a milestone. However, while some asset managers hope it is the beginning of a more open investment culture, others are more circumspect.

-

Features

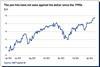

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

-

Features

FeaturesMeasuring the impact of non financial factors on GDP growth

In their paper entitled Modeling the Links Between Economic Growth, Socio-economic Dynamics and Environmental Dimensions: a Panel VAR Approach, the authors attempt to quantify direct and indirect causalities between economic growth and extra-financial dimensions, including demographics, biodiversity, climate change, political stability, inequalities and economic growth.

-

Features

FeaturesInvestors are paying for hedge funds' reluctance to use hurdle rates

Although two years have now passed since the US Federal Reserve started rapidly hiking interest rates, the likelihood that your hedge fund manager will have a ‘hurdle rate’ – a minimum rate of return before performance fees kick in – has not changed. Only a quarter of hedge funds, by our count, have such a threshold in place and the practice does not yet show signs of becoming more widespread, even though the risk-free rate has now exceeded 4% for well over a year.