All Features articles – Page 19

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - October 2021

The much-feared post-summer holiday effect on COVID-19 contaminations did not materialise. The current wave started earlier and statistics are already trending down in the US, EU, UK and Japan, although still at a high level. Full vaccinations are over 60% in the EU and UK, with Japan catching up fast. Emerging markets are still significantly behind in tackling the pandemic.

-

Features

FeaturesBriefing: Is equity duration risk about to step into the limelight?

In his memoirs, Sir Laurence Olivier tells how, in 1967, he was suddenly taken ill during a National Theatre production of August Strindberg’s Dance of Death. His understudy stepped into the role for just four nights, but in that short time, “.…walked away with the part of Edgar like a cat with a mouse between its teeth”. A star was born. Fifty-five years later, Sir Anthony Hopkins, with a career just as stellar as his one-time mentor, was the oldest-ever recipient of an Oscar for best actor.

-

Features

FeaturesAccounting: A costly mistake

Maybe you missed it. Or perhaps you were stuck in some interminable queue at an airport. But the United Kingdom’s audit watchdog revealed in August that a disciplinary tribunal had slapped audit giant KPMG with a £13m (€15m) fine, parked it on the naughty step with a severe reprimand, and ordered it to conduct a series of reviews into what went wrong.

-

Features

FeaturesAhead of the curve: The future of quant credit

The past several decades have seen quantitative strategies established as an important feature of global equity markets. In 2019, less than one quarter of the more than $30trn (€25trn) of US equities was held by human-managed funds.

-

Features

FeaturesLong term matters: Vaccine apartheid and investors

This column last covered COVID-19 vaccine inequity in June. Since then, using The Economist’s model of “excess deaths”, there may have been more than 4m deaths globally. That means 37,700 people dying every day, arguably unnecessarily. This number comes with many caveats but it’s possible (indeed probable) that the figure could be much higher.

-

Features

FeaturesStrategically Speaking: Aviva Investors

Insurance-owned asset managers can be difficult to pigeonhole. Some have forged strong specialisms, often in fixed income, but now also in alternatives like property or niche credit. Others have remained a corporate backwater absorbed by group general-account assets.

-

Features

FeaturesFixed income, rates, currencies: Not quite back to normal

As the world struggles to get back to pre-pandemic conditions, with schools and offices open, economic forecasting seems even less predictable than ever. Take August’s US payrolls report, which again confounded most forecasters. Analysts scrambled to explain why the headline job gains were so weak, particularly after the huge (forecast-beating) gains the previous month.

-

Features

FeaturesBriefing: Private market fees

In today’s low-interest-rate and low-return environment, investing in private markets has become a requirement for virtually every institutional investor. Private markets are where investors can obtain the extra returns they need and can no longer earn from listed assets, thanks to the liquidity premium and higher risk/return profile of non-listed assets.

-

Features

FeaturesBriefing: Germany’s Spezialfonds are weathering the crisis well

Institutional investors in Germany continue to invest in funds despite the challenging conditions. In the middle of 2021, the volume of Spezialfonds – Germany’s vehicle for professional investors – on the Universal-Investment platform stood at almost €474bn. This represents an increase of 36% over the past 12 months. According to most observers, it has been one of the most exceptional periods in a long time.

-

Features

Pensions Insider: A tricky business: compensation for mismanagement

In the fourth of a series of articles aimed at empowering trustees, our insider discusses what happened in a case of fraud

-

Features

FeaturesPerspective: Time to weigh collective DC

The UK finally legislates for a collective alternative to pure DC. But will employers be interested?

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - September 2021

The delta variant has caused a new COVID-19 wave in many places but it is different in character from previous ones. New hospital admissions are typically from among the unvaccinated. The average age of COVID patients has also come down significantly. In western Europe, the current wave seems largely under control, albeit at higher levels in the old EU member states.

-

Features

FeaturesPerspective - After Merkel: in search of a new model for pensions

Germany’s new government will feel the pressure to transform the pension system. Some parties have embraced new funded concepts and have put forward credible ideas

-

Features

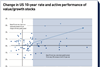

FeaturesAhead of the curve: Will rising rates see value stocks win?

There is growing global anticipation that central banks are likely to increase short-term rates. The spectre of inflationary pressure on longer-term rates looms large. What does this mean for value and growth stocks? Value might be expected to come up top and growth to lose out. But this is not the whole story. We examined stock returns during several historical periods of rate increases in the US and UK to see which factor would ultimately come out on top, and when.

-

Features

FeaturesStrategically speaking: Goldman Sachs Asset Management

If you are a pension fund, insurer or sovereign wealth fund and you haven’t heard from Goldman Sachs already, it probably won’t surprise you to learn that they want to talk to you – about a variety of alternative investment opportunities they want to put your way as a potential debt or equity fund investor, co-investor or all three.

-

Features

FeaturesBriefing: The sustainability missing link

Love him or loathe him, no one can doubt that Tesla CEO Elon Musk has a penchant for self-publicity and a talent for disruption in industries from automobiles to space. He has lately taken an interest in the metals and mining sector. In June, he tweeted that he would provide a “giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way”.