All Features articles – Page 25

-

Features

FeaturesAhead of the curve: Grasping intangible assets

Even the name hints at the challenge: intangible assets are hard to value. Recently, investors have looked to these assets to explain a decade of underperformance by value stocks. But new research suggests no tangible performance benefit from adjusting for intangibles.

-

Features

FeaturesBriefing: An unfortunate lack of ambition

The second Capital Markets Union (CMU) Action Plan of the EU Commission lacks ambition. This at a time when the EU Commission wants to set an industrial policy for the EU to bolster competitiveness in key sectors. It also comes shortly before the UK’s departure from the EU. Yet a vision of what the EU wants to achieve, by when and how, is missing.

-

Features

FeaturesStrategically Speaking: BlueBay Asset Management

Nowadays, it seems fair to ask asset managers whether they believe they can fulfil their clients’ needs while at the same time doing their bit to fight COVID-19.

-

Features

FeaturesFixed Income, Rates, Currencies: Vaccine boosts bullish markets

The swings in outcome predictions as the vote counting began in the US election were large. From the realisation that there was no blue wave of Democrat success, to a possible re-election for Donald Trump, to a Joe Biden win but with a Republican Senate, it was tricky to comprehend the investment implications.

-

Features

FeaturesUS endowments: Success breeds success

Perhaps no single group of institutional investors elicits as much fascination and admiration as US university endowments – in particular those of the Ivy League, and among that elite group the Yale and Harvard endowments in particular.

-

Features

FeaturesBriefing: Feast or famine

With the end of the COVID-19 pandemic still out of sight, any forecast of the size of economic damage it will inflict has to be viewed with caution. Yet there seems to be a consensus that default rates on leveraged loans will stay elevated throughout 2021 and beyond.

-

Features

FeaturesResearch: Resilience is the new watchword

In the first of two articles, Pascal Blanqué and Amin Rajan ask whether the current volatility in asset prices is a buying opportunity or the halfway stage in a prolonged bear market?

-

Features

FeaturesBiden signal is green for ESG

For many, US president-elect Joe Biden spells hope. From an ESG-perspective, there are two main aspects to this phenomenon.

-

-

-

Features

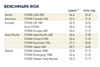

FeaturesIPE Quest Expectations Indicator - November 2020

The two overriding concerns for global markets are the resurgence of COVID-19 cases in many parts of the world and the US elections. In relation to the pandemic it is impossible to know exactly when it will be brought under control. In the US there is a real chance that Joe Biden will win the presidency and the Democrats gain a majority in the senate.

-

Features

FeaturesAccounting Matters: Who sets the standards?

You are what you know, the saying goes. And it goes without saying that the 211 comment letters the International Accounting Standards Board (IASB) received on its Primary Financial Statements (PFS) project will represent some diverse viewpoints.

-

Features

FeaturesPrivate Markets - Agriculture: A growing asset class

Consumer demand, technology and government policies to encourage regenerative farming are creating opportunities for investors

-

Features

FeaturesAhead of the curve: Gold all set to shine during uncertain times

Which asset has no cash flow or yield, has a volatility similar to equities even though its long-term performance lags behind equities, and which has also had long periods of negative returns? Gold.

-

Features

FeaturesBriefing - ILS: resilience despite the thrills

Institutional investors have piled into insurance-linked securities (ILS) with the goal of adding reliable returns and a touch of diversification to their investment strategies.

-

Features

FeaturesBriefing: Tail-risk hedging lessons from the corona crisis

The coronavirus crisis illustrates that equity collar strategies may still have a place for pension funds

-

Features

FeaturesPrivate Markets - Venture Capital: The case for VC and growth

European pension funds could significantly improve member retirement outcomes by allocating to venture capital and growth equity

-

Features

FeaturesFixed Income, Rates, Currencies: Economy reaches tipping point

The global reflation trade, and with it the outlook for further dollar weakness, seems paused as speculation on the outcome of the imminent US presidential election diverts attention and has many retreating to neutral positions.

-

Features

FeaturesPrivate Markets: Denmark's Industriens Pension

Industriens Pension looks forward to a continuing positive experience investing in private markets

-

Features

FeaturesPerspective: Manager selection in a pandemic

The social distancing restrictions imposed to contain COVID-19 have made external asset manager selection more demanding, but investors are adapting