All Features articles – Page 30

-

Features

FeaturesDollar/sterling: The road ahead for cable

The twisting path of the dollar/sterling relationship over 2020 will provide ongoing theatre, punctuated by moments of intensity

-

Features

FeaturesAhead of the Curve: The trade war and Asia

The rivalry between the US and China looks set to dominate Asian affairs in the future and cannot be ignored by responsible investors. The escalation of tensions at the start of Donald Trump’s presidency led to an increase in trade barriers and impacted growth; now a temporary truce has been agreed but uncertainty remains, as do tariffs on Chinese exports to the US. The new bilateral agreement is a positive step, but investors should take a long-term view; the economic and strategic rivalry looks set to continue and some sectors are better placed than others to adapt to this landscape.

-

Features

FeaturesESG: What drives ATP to divest?

Short of flying someone to Mexico City to knock on the door of the mining and transport company’s headquarters, the Danish pension fund had done all it could. Selling off its DKK13m (€1.7m) block of shares in Grupo México was not what ATP really wanted to do at the end of last year.

-

Features

FeaturesEmerging market outlook

Emerging markets have a knack for being in the headlines for the wrong reasons. They also stand out as sources of growth for investors who face low interest rates and muted economic performance in the developed world

-

Features

FeaturesGeopolitical risk: The new norm

Geopolitical risk is now the norm and not the exception, and brings with it a rise in volatility,” says Joyce Chang, chair of global research at JP Morgan, adding: “This volatility has tended to create more noise than trend.”

-

-

-

Features

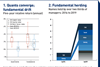

FeaturesIPE Quest Expectations Indicator: February 2020

Net bond sentiment is trending down, yet remains stable in Japan

-

Features

FeaturesBriefing: Central bank about-turn bolsters gold

Gold is unlike any other commodity. It has few industrial applications of any note. It is widely used in jewellery partly because of its aesthetic appeal but also in many cases as a form of investment. Central banks distance themselves from acknowledging the precious metal as a kind of universal currency yet still keep thousands of tonnes of it locked away in their vaults.

-

Features

FeaturesAhead of the Curve: Avoid the crowds in EMs

Emerging markets (EMs) look set to be the most important growth engine of the 2020s as their consumption levels rise and China follows a saw-toothed growth path towards the economic top spot. However, asset-allocators need to remove themselves from the malign legacy of the 2010s if they are to tap this growth.

-

Features

FeaturesClimate change and AI set to transform investing

As the new decade begins, it is becoming clear that climate change and artificial intelligence will reshape the future of investing

-

Features

FeaturesAre cryptocurrencies an asset class for institutional investors?

Cryptocurrencies are sweeping the world in terms of news headlines but how should institutional investors react?

-

Features

FeaturesThe proof of the Brexit pudding is in the eating

Brexit “got done”, to paraphrase the British prime minister, at the end of January. But the exact form it will take is still to be determined

-

Features

FeaturesFixed income, rates, currencies: A confident start to the year

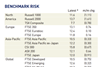

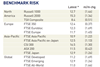

Undoubtedly a good year for financial assets, 2019 ended on a bright note with the broad, and relieved, consensus that the China/US trade conflict might be de-escalating

-

Features

FeaturesESG: Standards specialists tackle sustainable finance

When it comes to language the world of ESG can feel a mess. Different terms are often applied inconsistently and often interchangeably to various approaches.

-

Features

FeaturesWhere insurers are placing their money

Insurers’ investment decisions can influence economic growth and developments in capital markets

-

-

-

Features

FeaturesIPE Quest Expectations Indicator: January 2020

Bond sentiment remains stable, but still negative. US net bond sentiment is edging towards zero, which is surprising as the Fed is set on neutral.

-

Features

FeaturesAccounting Matters: Inflation measurement dilemma

If there is one issue that has seized the attention of defined benefit (DB) sponsors this reporting season, it is whether inflation should be measured using the consumer prices index (CPI) or the retail prices index (RPI). And Lane Clark & Peacock (LCP) partner Alex Waite is clear why: “There is a formula [for RPI] and the formula is wrong. It is like having an error in a spreadsheet,” he says.