All Features articles – Page 33

-

Features

FeaturesAhead of the curve: New economy, same old returns?

“You can see the computer age everywhere but in the productivity statistics.”

-

Features

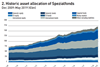

FeaturesGerman Spezialfonds show modest asset growth

Germany’s Spezialfonds market showed modest positive growth in 2018 in the face of challenging market conditions, with total assets approaching €1.5trn.

-

Features

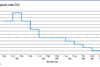

FeaturesBriefing: Draghi’s parting gift on ECB stance

If anyone in Europe was left in any doubt on 11 September about the dovishness of the European Central Bank (ECB) under Mario Draghi’s leadership, by close of business on the next day their doubts were surely dispelled. On that day the outgoing president of the ECB unleashed a bout of monetary easing, in an attempt to boost euro-zone inflation from 1% to its target of “below, but close to, 2% over the medium term”.

-

Features

FeaturesBriefing: US makes rapid turnaround

Father Christmas delivered a sack of coal to equity markets last Christmas Eve, with the S&P 500 index losing 1.8%, following a three-day slide. Forecasters had previously been expecting two or three rate hikes in December, as Federal Reserve chairman Jerome Powell steered that discussion. He had mistakenly assumed that the economy had not yet reached a normal, neutral level but it already had, forcing him to backtrack.

-

Features

FeaturesBriefing: Deep tensions threaten EU vision

This is not a commentary on the UK within or without Europe. Brexit has been a compelling distraction but it is one macroeconomic strand in a complex world. The overwhelming coverage has also moved attention away from key internal tensions within the European project.

-

Features

FeaturesBriefing: Coping with lower for much longer

German institutional investors have shifted their asset allocation due to low bond yields

-

Features

FeaturesEverything is still possible

Markets are on edge as a result of difficult economic and geopolitical forces. Risks are still skewed to the downside. Trade tensions have not abated, rather there is a possibility of further escalation in the future, which looks like reducing investment, and damaging already apprehensive outlooks.

-

Features

FeaturesGovernment Pension Investment Fund: Widening the reach

The president of Japan’s €1.3trn Government Pension Investment Fund (GPIF) reflects on the challenges of century-long stewardship

-

-

-

Features

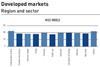

IPE Quest Expectations Indicator: September 2019

Market sentiment has split in two. For the euro-zone and the US, there was a correction that did not affect trends and equities are still favoured. In the UK and Japan, sentiment is moving towards favouring bonds

-

Features

FeaturesPension promises: Hybrid plan accounting

Staff at the International Accounting Standards Board (IASB) are sketching out an approach to tackle so-called hybrid pension plan accounting

-

Features

Briefing: Sri Lanka after the bombings

The tragic Easter Sunday bombings have devastated tourism, a key plank of the economy

-

Features

Ahead of the curve: The psychology of contrarianism

Sociologists are likely to see contrarian investors as deviants, while psychologists may see them as healthy, ‘independent’ thinkers

-

Features

FeaturesGlobal conflict: Another side of the triangle

So much attention is focused on the trade conflict between the US and China that it is all too easy to miss the bigger picture

-

Features

Briefing: The cliff-hanger of European banks

It has been a bad decade for European financials, with share prices still a fraction of their pre-crisis highs

-

Features

FeaturesPassive investment: Dawn of a new banner theme

This follow-up article on the rise of index investing highlights how pension plans are seeking to promote stewardship among their index managers

-

Features

FeaturesCross-border pensions: Barriers to entry

The experience of Bosch shows that a better framework is required for cross-border pensions

-

Features

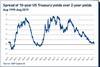

Fixed income, rates, currencies: A bleak outcome

This year’s summer tensions in shallow markets have again been apparent. The fallout from the trade dispute between China and the US is having a global impact. Together with economic weakness almost everywhere, a global policy easing cycle could be imminent.

-

Features

Briefing: Give credit to CDS indices

DB pension funds could benefit from synthetic credit exposures provided by credit default swap indices