All Features articles – Page 31

-

Features

FeaturesAhead of the Curve: Measuring the right thing

The old adage, ‘measure twice, cut once,’ only works if you measure the right thing. The prominence of GDP growth as the ultimate gauge of economic performance, for example, is increasingly a case of measuring the wrong thing. A single metric cannot hope to capture all the complex trends that develop below the surface of a modern knowledge and services-based economy.

-

Features

FeaturesDutch hedging strategies: Dynamic approaches in favour

Levels of interest rate hedging cover used by Dutch industry-wide pension funds vary widely, according to figures published late last year by pensions supervisor De Nederlandsche Bank (DNB).

-

Features

FeaturesWhen safe haven assets aren’t safe

In the current environment, investors look set to lose money on European government bonds – a quintessential safe-haven asset

-

Features

FeaturesAsset management faces systemic risk questions

When will the next financial crisis hit? Over 80% of respondents among a sample of 500 institutional investors surveyed by Natixis Investment Managers expect a crisis to take place within the next five years.

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.

-

Features

FeaturesPerspective: Carlo Cottarelli

Carlo Cottarelli, the Italian economist and former IMF director, says fixing the European economy will mean taking difficult decisions

-

Features

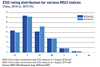

FeaturesChina: On a long climb up the ESG ladder

China is the world’s biggest emitter of greenhouse gases, compels imprisoned Muslims in Xinjiang to toil in factories, and has Communist Party committees embedded in companies, exercising a shadowy influence over management. It is, in other words, not exactly a poster child for good ESG performance.

-

Features

FeaturesPensions depositaries: IORP II’s new consolidation option

European pensions legislation raises the possibility of a new kind of consolidation vehicle that could also accommodate large Dutch mandatory industry-wide pension funds

-

Features

FeaturesHow to improve EIOPA’s stress test

EIOPA’s 2019 stress tests already included substantial improvements, but the cash flow analysis could be improved further

-

Features

FeaturesESG Report: SAAving the world?

Integrating ESG has become commonplace in institutional investment, but generally the discussion has focused on areas such as security selection and stewardship

-

-

Features

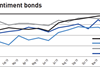

FeaturesIPE Quest Expectations Indicator: December 2019

With the shift to a strong negative bond sentiment in the UK, markets have again split. For the UK and EU, the figures are more negative and trending down.

-

Features

FeaturesAhead of the Curve: Value investing in the next decade

Winds of change are blowing relentlessly across the globe and the investment world is no exception. Central to this evolution is the growth of intangible assets, ranging from brands and patents to franchise agreements and digital platforms.

-

Features

FeaturesAsset Allocation: Good news buoys risk markets

Several factors have given risk markets a boost and propelled risk-free rates higher. These include diminishing fears of an economic slowdown, a potential rapprochement in trade negotiations and a reduced risk of a ‘no-deal’ Brexit.

-

Features

Emerging market debt: Argentina makes investors cry

Who needs Pennywise the terrifying clown when one has Argentine bonds in their investment portfolios?

-

Features

FeaturesiTDFs: A formula to end retirement blues?

All over the world, the financial industry is grappling with the ‘ideal’ post retirement investment strategy and with how best to pay out income in retirement. There is an arms race and the question is the following: who will win the retirement agenda?

-

Features

FeaturesBriefing: Peer-to-peer securities lending

The words scale, operational efficiency and lower cost feature regularly in the State Street discussion of its new peer-to-peer securities lending product. Direct Access Lending enables direct, principal loans between its lending clients and its borrowing clients.

-

Features

ESG: UK regulator turns sights on climate disclosures

With environmental risks taking a more central role in investment strategies, regulators have also been looking at what actions they can take.

-

Features

Corporate reporting: Where were the parents?

Financial reports are normally dull affairs. Apart from the endless reams of paper detailing figures that few people understand, most of us just want to know a few key facts: whether the bottom line profit number is higher or lower than last year; whether the overall balance sheet can be summed up with a correspondingly big number – big is always better; and, critically, whether there will be a dividend.