All Features articles – Page 26

-

Features

FeaturesAhead of the curve: COVID-19 and short-termism: finding the right balance

Finding a way to meet short-term needs without compromising long-term strategy has never been easy for businesses. The radical uncertainty introduced by COVID-19 has made the task much harder.

-

-

Features

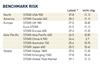

FeaturesIPE Quest Expectations Indicator October 2020

Globally, net equity sentiment is close to record levels, while net bond sentiment is flat or down to near record levels. A scenario explained by a virtual consensus that central banks can continue to pump liquidity into the system and this will eventually kickstart economies. Meanwhile, economists are predicting a long and deep slump.

-

Features

FeaturesAccounting Matters - UK DB pension schemes: One step forward, two steps back

As sometimes happens with Easter, one of the surveys of the UK pensions accounting landscape from consultants Lane Clark & Peacock (LCP) was later than usual. And, like an Easter egg, this keenly awaited overview of the net funding position of FTSE 100 defined benefit (DB) pension schemes comes in two halves.

-

Features

FeaturesLong term matters: Addressing autocratic risk

In an email interview, economist and MacArthur ‘Genius’ Fellow, Emmanuel Saez, confirmed what many investment insiders know: “Markets are notoriously bad at anticipating catastrophes.”

-

Features

FeaturesBriefing: Growth beyond COVID

The outlook for institutional investors may be gloomy, with the global economy in recession and interest rates stuck at extremely low levels.

-

Features

FeaturesBriefing: Which way will inflation blow?

Investors pondering the future course of inflation are scratching their heads – faced as they are with a powerful array of deflationary factors, opposed by a potent lineup of inflationary factors.

-

Features

FeaturesBriefing: Germany finally issues green bonds

There was little doubt that the German finance ministry would eventually tap the green bond market. Germany is committed to reaching net zero greenhouse emissions by 2050.

-

Features

FeaturesBriefing: A time to be calm and focused

The corona pandemic has become an emotional rollercoaster for investors. First, came the market collapse, followed by panic sales. Then, hot on the heels of the turmoil, normalisation and new stock-market highs.

-

Features

FeaturesSharing Economy: Think impact, build a legacy

As the world adjusts to COVID-19, amid the uncertainties and dangers that lie ahead, there should still be time to dream of a better world.

-

Features

FeaturesPensions first in move toward UK mandatory climate risk reporting

Mandatory reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) has long been a topic of discussion in the UK. It is almost hard to believe that a definitive move to make it policy is only a few months fresh.

-

Features

FeaturesFixed income, rates, currencies: Reality gap widens

August 2020 saw the US Treasury market post one of its worst monthly performances since November 2016, while global equities, led by the US, reached new highs.

-

Features

FeaturesPerspective: What is trusteeship worth?

Running a pension fund is a difficult job, whether for an executive, a professional trustee, or a member-nominated representative

-

-

-

Features

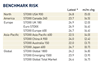

FeaturesIPE Quest Expectations Indicator September 2020

US COVID-19 figures are receding, to the extent that Brazil has taken over as the world’s worst managed country. A number of western European countries are experiencing a minor rebound, likely because of holiday travel. India has suffered a high death toll but this is partly a reflect of its huge population.

-

Features

Accounting matters: Totalling the sub-totals

A project that at its simplest is about the layout of financial statements should be uncontroversial. But the International Accounting Standards Board’s Primary Financial Statements project faces a potentially big test.

-

Features

Ahead of the curve: Alternative data offers insight

The measures required to stop the spread of COVID-19 – social distancing and government-mandated lockdowns – mean that, unlike in previous recessions, services have led the economic decline.

-

Features

FeaturesFixed income, rates, currencies: Still facing anxious times

Developed market government bond yields have spent the summer drifting lower as risk assets traded better. However, this benign climate has not lifted the fog of confusion caused by COVID-19.