All Features articles – Page 27

-

Features

Briefing: Timing is everything in distress

After an extended period in the wilderness, distressed debt funds – bereft of opportunities because of ultra-low interest rates and economic buoyancy – are back in the spotlight with large players coming to the market.

-

Features

Briefing: The long march to deleveraging

Global debt reached a new record during the first quarter of this year, reaching 331% of GDP, or $258trn (€229trn), according to the Institute of International Finance, the global association of the finance industry.

-

Features

FeaturesLong term matters: Tales of a chance ESG investor

I didn’t intend to get a permanent job in ‘responsible investment’: my pitch for a consulting contract got misfiled in a recruitment folder and the rest really is history. Having held two good jobs in the sector, at USS and Axa Investment Management, I appreciate the 12 years I’ve spent inside the investment world.

-

Features

FeaturesPerspective: How to survive a reputational crisis

Pension fund trustees could benefit from developing a clear policy stance in relation to controversial questions

-

-

-

-

Features

FeaturesIPE Quest Expectations Indicator July 2020

Global statistics indicate that while new cases of COVID-19 are rising, case mortality is stable at about 4,000 per day. The situation is in hand, but the danger is not over. First, the Americas, dominated by the US and Brazil, are confronted by rising case statistics. Second, there are signals of a rebound in autumn, both in theory as medical experts embrace the thought and in practice, as the figures in Iran show. Third, the equality protests increase the chances of a second wave.

-

Features

Accounting Matters: Controversy over sponsor rebates

In 2014, staff at the International Financial Reporting Standards Interpretations Committee (IFRS IC) – the body responsible for developing guidance on the application of IFRSs – recommended the approval of an amendment to its asset-ceiling guidance.

-

Features

FeaturesAhead of the curve: Liquidity has been the litmus test for China’s bond market

It is no safe haven, but China has provided bond investors with important shelter through the storm

-

Features

FeaturesStrategically Speaking: Asoka Woehrmann, DWS

DWS has just unveiled a new, simplified global structure. CEO Asoka Woehrmann explains how the reorganisation will allow the firm to focus on its key business lines

-

Features

Briefing: The unbearable lightness of investing

Open the newspaper. Any newspaper. Read the front page and then the money pages. Absorb, assimilate, repeat. After half a dozen goes, a pattern is clear.

-

Features

FeaturesLong term matters: Risk calls for universal investors

I’m looking for a senior executive from a major institutional investor who has “systemic risk” in their job description.

-

Features

Research: The rise of climate investing in passive funds

COVID-19 is a devastating reminder of the fragility of life on Earth. It will be a key defining force of change in our age, alongside global warming.

-

Features

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

Features

FeaturesEU sustainability focus shifts

EU sustainable finance policy-making began with a vengeance in 2018, when the European Commission unveiled and embarked on its Action Plan for Financing Sustainable Growth. Two years later, the Commission is preparing to adopt a new, “more ambitious and comprehensive” sustainable finance strategy.

-

Features

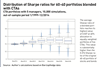

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

Features

FeaturesInvestment Strategy: Towards sustainable portfolio theory

This year marks the 30th anniversary of the 1990 Nobel prize in Economics given to Harry Markowitz, William Sharpe and Merton Miller. IPE is marking this in several ways. The first event took place at the IPE annual conference in Copenhagen in December 2019, with a panel discussion following on from the showing of a delightful video. The video was based on a few days that TOBAM CEO Yves Choueifaty and I spent with Markowitz in his office in San Diego in June of that year and showed Markowitz’s charm and humility despite his great achievements.

-

Features

FeaturesPerspective: Trouble in Lykkeland

The decision to appoint Nicolai Tangen, a hedge fund owner, to the position of CEO at Norges Bank Investment Management has proved controversial

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.