All Features articles – Page 66

-

Features

Appeasing the gatekeeper

Last year I attended a drinks reception organised by a UK consultancy. The event was arranged specifically to allow the firm’s staff to meet with the asset management community. The theme running through the opening remarks was simple: “We have no current or future plans to offer fiduciary management, therefore we will never compete with you.”

-

Features

PLSA Investment Conference: Industry embraces FCA asset management review

The question of whether the asset management market is working for pension funds and other investors, as the UK Financial Conduct Authority (FCA) is asking, was a theme at the UK pension fund association’s conference in Edinburgh.

-

Features

FeaturesBanks and LDI

The rise of liability-driven investments (LDI), pairing cashflow-matching assets with forecast liability streams, has developed in tandem with a broad, overall maturing of the liabilities of the European occupational pension sector

-

Features

Commodity Prices: If only we could blame China

Niels Jensen argues that the strong dollar and rising debt levels among emerging market corporates bear some of responsibility for the slump in global commodity prices

-

Features

Diary of an Investor: Muddy boots on

We pension funds at least have the luxury of not being stuck behind our screens all the time, trading or monitoring our portfolio

-

Features

Breaking Germany’s mould

Federal civil servants at two government ministries are searching for a workable policy to promote occupational pensions

-

Features

CEE equities – Middle ground promise

David Turner assesses why Central and Eastern European equities are catching the eye of many investors

-

Features

The ceiling has no fans

The International Financial Reporting Interpretations Committee (IFRIC) has proposed potentially far-reaching changes to its asset-ceiling guidance. The proposals have their fair share of critics

-

Features

FeaturesUK Local Government Pensions: Choose your partner

After years of debate, concrete details regarding the future of the UK local authority pensions sector are emerging

-

Features

Focus Group: Risk-factor investing concepts

Just over half of the investors polled for this month’s Focus Group currently allocate assets to strategies that employ risk-factor investing concepts

-

Features

Investment: Convex protection

With record-low corporate spreads and volatile equity markets, is it time to take a closer look at convertible bonds?

-

Features

FeaturesCross-Border Pensions: Dutch in first Malta DC set-up

Plegt-Vos is the first Dutch company to relocate a defined contribution plan to Malta.Maarten van Wijk reports

-

Features

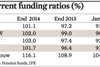

FeaturesDutch Funding: Facing a painful squeeze

Dutch pension funds’ nose-diving coverage ratios underline just how futile various measure have been in improving funding and minimise rights cuts

-

Features

ESG: Investment in society

Jonathan Williams reports on niche bonds that are growing in prominence as they move into areas previously filled by charities and the government

-

Features

FeaturesHow we run our money: Industriens Pension

Laila Mortensen, CEO of Denmark’s Industriens Pension, tells IPE about her efforts to improve the fund’s main pension product

-

Features

Negative rates are truly negative

It is instructive to remember that only a few years ago it was common for negative interest rates to be dismissed as impossible.

-

Features

2015 Returns: Strong ATP performance bucks the downward trend in returns

Investment returns at many European pension funds came crashing down in 2015 compared with the previous year. Denmark’s ATP was the only exception, posting a 17.2% return.

-

Features

ABP open season

Would you set up an ABP now if you were creating a public sector pension regime from scratch for the Netherlands? The simplicity of a single scheme and the economies of scale in investment and administration all call for it. But other factors speak against

-

Features

IORP II inches ahead

The revised IORP Directive is one step closer to fruition, after MEPs agreed on a final draft of the law.

-

Features

Ahead of the Curve: MiFID II starts to bite

Mark Croxon looks at the impact the new EU directive is likely to have on the workflow of investment firms