IPE's EU Coverage – Page 22

-

News

NewsEIOPA names members of new pensions stakeholder group

PensionsEurope’s Leppälä and APG’s Steenbeek among returning, new IORP representatives

-

News

NewsEIOPA PEPP proposal triggers concerns about reporting burden

EIOPA wraps up second PEPP consultation ahead of delivering its advice to the Commission in August

-

News

Amundi completes Sabadell Asset Management acquisition

Acquisition adds around €21bn to Amundi’s assets under management

-

News

AAE wants discussions with IFoA to cover MRA legal challenge

Chair of AAE says questions of arbitrage surrounding actuarial qualifications need to be looked into

-

News

NewsAsset manager roundup: Natixis and La Banque Postale agree merger

New Ostrum Asset Management to fixed income and credit-focussed joint entity to be owned 55%/45% by Natixis and La Banque Postale

-

Country Report

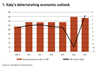

Country ReportItaly: IORP II in limbo

The EU’s IORP II directive has yet to be fully implemented by Italian pension funds

-

Features

FeaturesEU sustainability focus shifts

EU sustainable finance policy-making began with a vengeance in 2018, when the European Commission unveiled and embarked on its Action Plan for Financing Sustainable Growth. Two years later, the Commission is preparing to adopt a new, “more ambitious and comprehensive” sustainable finance strategy.

-

News

NewsNew ‘informal’ sustainable finance group formed, comments on NFRD

Group comprises ‘stakeholders with different backgrounds’: Efama, Schroders, WWF, ACCA, ShareAction, and others

-

News

NewsFCA outlines thinking about UK prudential rules for investment firms

‘Investment firms should be aware of the scale of the change the IFD/IFR represents’

-

News

EC opens for applications to new sustainable finance advisory body

Platform on Sustainable Finance will play a key role with regard to the taxonomy and the Commission’s future strategy on sustainable finance

-

News

AAE extraordinary meeting to hear IFoA capped subs proposal

IFoA has said withdrawal plus possible MoU ‘a likely consequence’ if proposal rejected

-

News

EC presented with plan for capital markets union ‘game-changers’

High-Level Forum sets out plan, with 17 clusters of ‘granular’ measures, for bringing about an EU capital market

-

Special Report

Special ReportEuro-zone: A crisis like no other

The COVID-19 pandemic, alongside the associated economic shutdown, has had an unprecedented effect on EU member states

-

Special Report

Special ReportEurope’s investment outlook: The complex game of market guesswork

Investors are having to play a complex game of market guesswork

-

Opinion Pieces

Opinion PiecesEU integration takes a hit

The symbolism should not be missed. One of the first responses to the COVID-19 pandemic in Europe was the closure of national borders.

-

-

Interviews

InterviewsOn the record: APG - A rethink is needed

Thijs Knaap, senior strategist at APG, says the pandemic means that investment strategies need to be reconsidered

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Hilde Blomme & Jona Basha

Resolving the ‘alphabet soup’ of corporate reporting framework

-

News

ECB presents climate-related risks expectations for consultation

Climate-related and environmental risks ‘can have a substantial impact on the real economy and banks’

-

News

Scientific Beta unrelenting in criticism of EC climate benchmark plans [updated]

Smart beta index provider follows up lambasting of TEG proposals with criticism of draft delegated acts