IPE's United Kingdom Coverage – Page 134

-

News

UK regulator demands improvement on ‘misleading’ fee disclosure

Asset managers ‘generally do not disclose all associated costs and charges’ and could face further regulatory action

-

News

NewsWatchdog to ‘level playing field’ on costs for DC schemes

FCA launches consultation on how to ensure value for money for defined contribution scheme members

-

Country Report

BlackRock appoints former Aon fiduciary lead in UK push

Sion Cole to lead the growing department after 15 years at Aon

-

Country Report

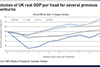

Deficits: All set for a bumpy ride

Choppy markets, economic uncertainity and Brexit are among the issues faced by UK sponsors and trustees

-

Country Report

Funding: Where do pension funds end?

Identifying the funding horizon means balancing objectives and expectations, particularly given likely prescriptive new funding rules

-

Special Report

UK Financial Reporting Council: On the radar

Reactions to the Kingman review on UK corporate reporting oversight

-

Features

FeaturesMacro matters: Brexit’s challenge for Europe

It is human nature to reduce the complexity of reality to simple rules, simple foci and simple decision points. In this, Brexit is no different

-

Features

FeaturesShunning the UK is a mistake

Continental investors hold nuanced views on Brexit. It is fair to say, however, that they generally see its impact as a negative factor for the UK economy, at least in the short term.

-

Country Report

CDC: Proposals gain approval

The UK government has proposed collective defined contribution schemes. The model is gaining traction after an initially lukewarm response

-

Features

Buyouts: Philip Green’s M&S venture

Philip Green, a British retail billionaire, is perhaps best-known for the controversy surrounding the pensions deficit of his defunct BHS high street chain

-

Special Report

Special ReportSterling scenarios

Sterling will remain mired in uncertainty as long as the conflict over Brexit is unresolved

-

Country Report

Country ReportLGPS pooling: Funds under pressure to comply

About 30% of assets have been absorbed by the new LGPS pools

-

Country Report

Country ReportFiduciary managers: A healthier market?

Standardisation of data provision could prove essential to driving greater competition in UK fiduciary management

-

Country Report

Auto-enrolment: A call for clarity

The government should set out its long-term policy on auto-enrolment contributions with a view to increasing the overall level

-

Interviews

On the Record: Looking beyond Brexit

We asked European pension funds whether they see value in investing in UK assets. Despite the uncertainty regarding Brexit, most still see opportunities in the long term

-

News

NewsFund managers expected to escape no-deal Brexit nightmare

Also: FCA publishes ‘near-final’ rules and guidance for transition to a post-Brexit world

-

News

UK professional trustees to face accreditation test to uphold standards

Independent trustees to be held to an increased level of scrutiny under new guidelines

-

News

Brexit: Nordic pension funds reveal their approaches to UK assets

SPK, Veritas and Apteekkien Eläkekassa explain their approaches to political risk in the EU

-

News

£8.6bn public sector fund appoints managers for equity protection

Merseyside names panel of five managers to advise on risk management after equity market bull run

-

News

UK regulator rejects MiFID II sector coverage fears

Andrew Bailey says the revised directive could save investors as much as £1bn in the next five years