All IPE articles in January 2021 (Magazine) – Page 2

-

Country Report

Country ReportCEE – Romania: Funds fight through

Conservative portfolios have served Romanian pension funds well through the crisis

-

Country Report

Country ReportCEE – Estonia: Preparing for a liquidity storm

A rule allowing early withdrawals is changing the dynamics of the Estonian pension business

-

Special Report

Special ReportDefined contribution: The engagement fallacy

The idea that successful defined contribution (DC) pension solutions require a high level of member engagement is being questioned

-

Features

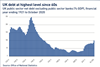

FeaturesFixed Income, Rates, Currencies: A very different recovery

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Features

FeaturesLong term matters: What kind of decarbonisation matters most?

This article was written on the fifth anniversary of the Paris Agreement. In 2015, the world committed to keep warming below 2°C, meaning decisive annual reductions in greenhouse gas (GHG) emissions. Instead we have had a 7% increase in GHG since 2015 and are on track for about 3°C warming with a high risk of irreversible tipping points.

-

Opinion Pieces

Opinion PiecesJapan is not that different

One of the abiding myths about Japan is that it is different from everywhere else. Not just distinctive in the sense that all countries have peculiarities but uniquely different.

-

Opinion Pieces

Opinion PiecesSocial purpose: the new dimension

Investors’ attention turned to human capital issues in 2020 as COVID-19 took hold – including the treatment of staff and other stakeholders, as well as dividend policy and executive pay in cases where companies have received taxpayer support.upport.

-

Opinion Pieces

Opinion PiecesThe real meaning of engagement

Empirical evidence suggests that individuals are unengaged with DC pensions. This is demonstrated by the vast majority of DC members remaining in default funds and reluctant to increase contributions.

-

Features

FeaturesESG: Engaging with sovereigns

One of the narratives and unfolding developments in the world of ESG is that of its broadening to asset classes beyond public equity. This generally keeps the focus on corporates, however, while another emerging strand is about sovereign issuers.

-

Interviews

InterviewsOn the record: Search for robust equity portfolios

IPE asked two investors how their equity portfolios are positioned

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Jesper Kirstein

In recent months, the asset management industry has been dominated by adjustments inspired by the COVID-19 pandemic. This article will try to look beyond this and address the question of where the asset management industry is moving in the medium to long term.

-

Features

FeaturesPerspective: Litigation - state of pay?

Changes in legislation like the UK’s Consumer Rights Act 2015 have led to an increase of class actions led by pension funds as they seek to recover investment losses

-

Features

FeaturesResearch: The shift from virtue to value

In the final article in a series of two, Pascal Blanqué and Amin Rajan argue that the success of ESG investing rests on a just transition to a low carbon future

- Previous Page

- Page1

- Page2

- Next Page