All IPE articles in June 2015 (Magazine)

View all stories from this issue.

-

Features

Fixed income: 2015 in sovereign bonds

The first four months of 2015 were characterised by a rally in sovereign bond markets, aided by accommodative central bank policy and mounting uncertainty over the sustainability of Greek debt.

-

Special Report

Special ReportTop 400 Asset Managers 2015: Global assets top €50trn

Once again, IPE surveyed over 400 managers for this year’s study, canvassing end-2014 data in most cases. The results give a broad overview of the global asset management sector, with granular depth on European managers and institutional business

-

Country Report

Altersvorsorge 2020: An ageing reform package

Switzerland’s system of direct democracy is complicating the debate about pensions reform

-

Special Report

Top 400: New perspective on equity strategies

Investors are waking up to the advantages of using equity strategies in portfolio construction to capture illiquidity, skill and style premia, according to Stuart Gray

-

Special Report

Top 400: Multi-asset – in search of opportunities

A complex and changing pensions market means responsiveness is key for asset managers, say Nigel Birch and Will Mayne

-

Special Report

Top 400: Disruptive change - an end to the innovator’s dilemma?

The combination of technology and innovation like exchange-traded funds looks set to change some aspects of the asset management value chain, according to Amin Rajan and Subhas Sen

-

Special Report

Top 400: A better deal on fees

Fee structures are imperfect and may be poor value. Nick Sykes outlines ways they could be improved for institutional investors and investment managers

-

Special Report

Top 400: Managing talent in a new world

Tim Wright says agility and innovation will be crucial to attracting and retaining key personnel in the asset management industry

-

Special Report

Top 400: The fee music’s still playing – for now

The institutionalisation of European asset management and changing investor fundamentals could limit the future profitability of the asset management industry, says Alastair Sewell

-

Special Report

Top 400: Time for compulsory stewardship

Asset owners and investment managers should be made to disclose their portfolio turnover and how they vote their proxies, according to Raj Thamotheram and Matthew Taylor

-

Special Report

Top 400: Investing for the future

Changing institutional investor thinking has profound implications for asset managers. Here, eight leading figures from six international organisations outline progress made on an initiative to realign institutional investment with long-term goals

-

Special Report

Top 400: Mass market – a brave new world

Andy Masters and Richard Clarke argue that asset managers need to be more focused on the end consumer and develop a range of products suitable for multi-phased retirement

-

Special Report

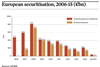

Special ReportRegulatory environment still weighted against Europe's ABS market

The European market for asset-backed securities has ample potential but suffers as a result of an unfavourable regulatory regime

-

Features

FeaturesEvent shortfall: Taking account of unmeasured opportunity costs

Investors should be aware of the costs incurred when reallocating assets within portfolios

-

Special Report

Euro-zone recovery: SME Lending – Affairs of credit

Everyone wants to secure funding for small businesses, which has led to initiatives across Europe designed to take up lending slack where banks have pulled back

-

Features

Ahead of the curve: Is there a bull in the China shop?

The rise in Chinese stocks up more than 60% since late 2014 has raised concerns about a bubble that might burst

-

Features

FeaturesAsset allocation: The big picture

Are strong equity markets signalling an optimistic outlook for economic growth? Possibly, although economic data – particularly from the US and China – has been pretty disappointing since the start of this year. This year’s strong equity performance may have more to do with the fact that money remains extremely easy and economic growth, although dull, remains steady.

-

Features

ECB should not allow funds to suffer ‘collateral damage’

The European pensions industry must not become collateral damage as the European Central Bank (ECB) rolls out its quantitative easing (QE) programme and increases pension deficits, PensionsEurope has urged

-

Interviews

On the Record: Are you anticipating a European recovery?

Three pension funds - APK, Fondenergia and Pensioenfonds TNO - share their views about Europe’s recovery

-

Country Report

Talking Heads: Ask the experts

Swiss Investors are grappling with negative bond yields and interests rates on cash deposits. We asked experts to assess the situation and share their thoughts for the future of the second-pillar