Latest from IPE Magazine – Page 113

-

Opinion Pieces

Opinion PiecesLetter from US: Politics forcing divestment

American pension funds have become embroiled in the cold war between the US and China and diversification strategies may be affected by the new scrutiny of investments in Chinese companies.

-

Features

FeaturesPerspective: Trouble in Lykkeland

The decision to appoint Nicolai Tangen, a hedge fund owner, to the position of CEO at Norges Bank Investment Management has proved controversial

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Rory Sullivan & Fiona Stewart

Better disclosure by asset owners is an important mechanism for driving sustainability in investment. But asset owners struggle with many aspects of sustainability reporting

-

Features

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator July 2020

Global statistics indicate that while new cases of COVID-19 are rising, case mortality is stable at about 4,000 per day. The situation is in hand, but the danger is not over. First, the Americas, dominated by the US and Brazil, are confronted by rising case statistics. Second, there are signals of a rebound in autumn, both in theory as medical experts embrace the thought and in practice, as the figures in Iran show. Third, the equality protests increase the chances of a second wave.

-

Country Report

Country ReportNordic Region: Pension funds step up to the plate

Nordic pension funds have been quick to offer support to local ecomomies affected by the coronaviris crisis

-

Special Report

Special ReportEuro-zone: A crisis like no other

The COVID-19 pandemic, alongside the associated economic shutdown, has had an unprecedented effect on EU member states

-

Opinion Pieces

Opinion PiecesThe shape of capital to come

In the Netherlands, the Afsluitdijk is a 32km by 90m dyke and causeway running between the provinces of North Holland and Friesland

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Equities in the time of the pandemic

The speed and impacts of the coronavirus pandemic have thrown up challenges for investors that will not be clear for decades

-

Special Report

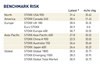

Special ReportTop 500 Asset Managers 2020

Asset managers in our listing are ranked by global assets under management and by the country of the main headquarters. Assets managed by these groups total €81.1trn

-

Features

FeaturesBriefing: Hybrids come into their own

Back in the days when sailors relied on sails, they used to dread the doldrums – that zone near the equator where trade winds converge, generating windless weather.

-

Special Report

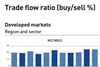

Special ReportEurope’s investment outlook: The complex game of market guesswork

Investors are having to play a complex game of market guesswork

-

Opinion Pieces

Opinion PiecesEU integration takes a hit

The symbolism should not be missed. One of the first responses to the COVID-19 pandemic in Europe was the closure of national borders.

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – The history of crises in US equities

The current US equity crisis conjures up shades of previous crashes

-

Special Report

Special ReportTop 500: Ebb and flow of a rising tide

2019 saw a stark increase in global assets as measured in our annual survey of the world’s leading asset management groups

-

Country Report

Country ReportNordic Region: Gearing up for for all weathers

Denmark’s biggest commercial pension fund has been reshaping itself to ensure it can meet members needs as well as react effectively to extraordinary situations

-

Features

Briefing: Six insights on PE

Considerations for private equity investors in light of the coronavirus pandemic

-

Opinion Pieces

Opinion PiecesSeize the possibilities of crisis

IPE’s 2020 Top 500 Asset Managers ranking shines a light on overall global managed assets in 2019, which increased by almost 22% in euro terms over the course of last year to €80trn.