Latest from IPE Magazine – Page 135

-

Special Report

Finland: Two to become one

The government is planning to unify the municipal and private-sector pension systems

-

Special Report

France: Act I of the pensions big bang?

The government’s PACTE law could transform the pensions landscape

-

Special Report

Germany: Tinkering at the edges

As yet no social partners have adopted the latest pension model in an already highly complex system

-

Features

FeaturesPension promises: Hybrid plan accounting

Staff at the International Accounting Standards Board (IASB) are sketching out an approach to tackle so-called hybrid pension plan accounting

-

Opinion Pieces

Opinion PiecesGreenwish: wishful thinking in the ESG world

Every so often I come across a paper which I think is a ‘must read’ and Duncan Austin’s ‘Greenwish: the wishful thinking undermining the ambition of sustainable business’* is one.

-

Features

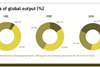

FeaturesGlobal conflict: Another side of the triangle

So much attention is focused on the trade conflict between the US and China that it is all too easy to miss the bigger picture

-

Features

FeaturesPassive investment: Dawn of a new banner theme

This follow-up article on the rise of index investing highlights how pension plans are seeking to promote stewardship among their index managers

-

Interviews

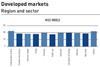

InterviewsOn the Record: Emerging markets

We asked two pension funds whether the distinction between emerging and developed markets still makes sense

-

Features

FeaturesCross-border pensions: Barriers to entry

The experience of Bosch shows that a better framework is required for cross-border pensions

-

Interviews

InterviewsHow we run our money: PGB

Harold Clijsen CIO of Dutch multi-sector Pensioenfonds PGB, speaks to Carlo Svaluto Moreolo about asset allocation, sustainable investment and member communications

-

Features

Briefing: The cliff-hanger of European banks

It has been a bad decade for European financials, with share prices still a fraction of their pre-crisis highs

-

Features

Briefing: Give credit to CDS indices

DB pension funds could benefit from synthetic credit exposures provided by credit default swap indices

-

Features

Briefing: Sri Lanka after the bombings

The tragic Easter Sunday bombings have devastated tourism, a key plank of the economy

-

Interviews

Strategically speaking: APG

If people ask Peter Branner why he moved from Sweden to the Netherlands to run the asset management arm of APG he might tell them that he is in effect chief investment officer for more than a quarter of the Dutch population

-

Features

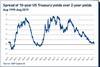

Fixed income, rates, currencies: A bleak outcome

This year’s summer tensions in shallow markets have again been apparent. The fallout from the trade dispute between China and the US is having a global impact. Together with economic weakness almost everywhere, a global policy easing cycle could be imminent.

-

Features

Ahead of the curve: The psychology of contrarianism

Sociologists are likely to see contrarian investors as deviants, while psychologists may see them as healthy, ‘independent’ thinkers

-

-

-

Special Report

Iceland: Full reform on the cards

Iceland is set for a broad revision of its 20-year-old pension laws

-

Features

IPE Quest Expectations Indicator: September 2019

Market sentiment has split in two. For the euro-zone and the US, there was a correction that did not affect trends and equities are still favoured. In the UK and Japan, sentiment is moving towards favouring bonds