Latest from IPE Magazine – Page 138

-

Features

IAS 19: How did they do it?

Two academics have analysed key amendments to IAS 19 and how they came about

-

Opinion Pieces

Opinion PiecesAnimal welfare: Probing the global meat complex

Everyone knows about ‘big oil’ and how much influence the global agribusiness sector has. But there is less awareness about the negative impacts of meat producers – the ‘global meat complex’.

-

Features

FeaturesPerspective: Growing buzz around cannabis

Legalisation of cannabis raises ethical questions for some investors, while presenting an investment opportunity for others

-

Features

FeaturesResearch: Passive investors, active owners

The rise of index investing raises important question about ownership rights and governance

-

Interviews

On the record: China

We asked two pension funds to tell us about the case for investing in China and their experience with investing in the country

-

Interviews

InterviewsStrategically speaking: Muzinich & Co

We are living in Disneyworld,” says George Muzinich, the CEO and chairman of Muzinich & Co, a New York-based investment manager specialising in corporate credit.

-

Features

FeaturesESG: Greenwashing under scrutiny

The term ‘greenwashing’ was reportedly coined by US environmentalist Jay Westerveld in 1986 in an essay about hotels’ practice of putting up notices in hotel rooms to encourage guests to reuse towels. He accused them of making false claims about being environmentally responsible since they only adopted such practices when they reduced costs.

-

Features

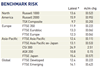

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

Features

FeaturesAhead of the curve: The bubbles to come

Market bubbles would not happen in a perfect world. But humans are not perfect and our economies are inherently unstable.

-

-

-

Interviews

InterviewsHow we run our money: Eni

Carlo di Gennaro, head of global group pensions at Eni, tells Carlo Svaluto Moreolo how the oil and gas company is streamlining its pension strategy

-

Features

FeaturesIPE Quest Expectations Indicator: July 2019

Markets are still driven by political risk and growth prospects. It looks like the two risks are working in the same direction this month.

-

Features

FeaturesIPE Quest Expectations Indicator: August 2019

It looks like political risk is taking a back seat to growth this month, continuing last month’s trend.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Adam Matthews and John Howchin

“The Brumadinho dam tragedy causes us to question if we have created the conditions for a set of disasters”

-

Opinion Pieces

Opinion PiecesLetter from the US: On a secure retirement path

The most significant changes to US retirement plans in more than a decade look set to be approved by Congress. On 23 May, the House of Representatives passed the Secure Act – Setting Every Community Up for Retirement Enhancement – by 417-3, and the Senate is also likely to approve it, with President Donald Trump unopposed.

-

Features

FeaturesPolicies needed

The new European Commission will inherit a coherent but partially implemented Capital Markets Union (CMU) in the autumn. But much needs to be done to consolidate, refocus and re-energise this landmark constellation of policies and objectives.

-

Country Report

Country ReportATP: Green signals

In its quest for better quant stock selection method, ATP has also reduced its carbon footprint by a quarter

-

Special Report

Special ReportEurope Outlook: Behind the gloom

Pessimism abounds about Europe’s prospects but is it justified?

-

Features

FeaturesBriefing: Shining a light on active ETFs

Exchange-traded funds (ETFs) have grown into a $5trn (€4.4trn) global industry by focusing on a few key selling points – low costs, liquidity, easy diversification and transparency.