Latest from IPE Magazine – Page 142

-

Asset Class Reports

Hedge Funds - Technology: The next generation

Advances in artificial technology and computing power are opening paths to new hedge funds strategies

-

Special Report

Special ReportTricky, but worthwhile

Help is at hand for institutional investors interested in pursuing, or deepening their efforts in impact investing

-

Special Report

Special ReportManager selection: Facing a difficult test

The resilience of private debt funds will be tested in the forthcoming downturn

-

Features

FeaturesCultivating judgement

One of the big challenges we face, both in the financial world and in everyday life, is how to overcome our biases

-

Country Report

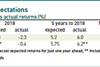

Country ReportInvestment: The limits of expectations

How are Dutch funds doing against their long-term targets?

-

Asset Class Reports

Asset Class ReportsCryptocurrencies: A match made in heaven – or hell

Cryptocurrencies could offer handsome returns to hedge funds. Or they could be a disaster

-

Special Report

Special ReportMulti-asset strategies: New tools

Quantitative easing has distorted the fixed-income markets, resulting in an increased need to manage liquidity within credit strategies

-

Special Report

Special ReportPublic Markets: Hard to pin down

A mishmash of blurred definitions and terminology borrowed from ESG and sustainability is marring the progress of impact investing in public markets

-

Features

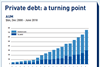

FeaturesChoose correctly on the private-debt journey

The short to medium-term outlook for private debt is complex to read, to say the least. There is mounting anxiety that the credit cycle may have run its course.

-

Country Report

State pension age: Another hurdle for pensions reform

Unions mistrust politicians following ‘many broken promises’

-

Special Report

Trade Finance: Funding tradewinds

Trade finance can offer an illiquid position in a volatile market, but its idiosyncratic nature can dissuade investors

-

Special Report

GIIN: Setting the bar

The CEO of the Global Impact Investing Network, an organisation dedicated to promoting impact investing, talks about the need for ‘baseline expectations’

-

Features

FeaturesTime for some good news on stewardship

Asset owners and managers can engage positively with the companies in which they invest and draw on the successes of previous interactions to ensure that change is permanent and for the better

-

Country Report

Country ReportAlmost solved...

Nicole Beuken, executive director of ABP, the largest pension fund in the Netherlands

-

Special Report

Special ReportAsset Allocation: Private credit is here to stay

Despite warnings of its imminent demise the asset class is here to stay

-

Special Report

Special ReportAP1 - A circular focus

Swedish buffer fund AP1 highlights resource efficiency as key to a sustainable investment strategy

-

Country Report

Country ReportKey Dynamics: A market overview

Alternatives, ESG adoption and further fund consolidation are the key trends highlighted by INDEFI

-

Special Report

Special ReportMarket Trends: Critical point

Private market lending now faces an important turning point

-

Special Report

Actis: Thinking deep about measurement

Private markets investor Actis is taking impact measurement seriously

-

Features

FeaturesPension funds act as Nordic drama engulfs Swedbank

Sweden’s largest pension funds have been thrust into leading roles in a money-laundering scandal over the past few weeks, as Swedbank was raided by fraud investigators and forced to fire its CEO.