Latest from IPE Magazine – Page 146

-

Features

FeaturesPension fund consolidators enjoy strong growth

Efforts to increase scale and improve efficiencies across the European pension fund sector are gathering pace, new data shows – but schemes still face hurdles

-

Features

FeaturesATP: A very Danish scandal

Fallout from scandals has left ATP without a chief executive and a tricky problem in choosing a successor to Christian Hyldahl

-

Interviews

On the record: Delivering on our promise

Dmytro Sheludchenko of Sweden’s AP1 buffer fund explains how it constructs and manages its factor-investing portfolios

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Manuel Adamini, Sean Flannery, Toby Heaps and Eloy Lindeijer

“Time to invite brown corporates to the green bond party”

-

Opinion Pieces

Opinion PiecesBrussels People: Europe’s conservatives eye Africa

Describing himself as “the most senior elected Brit in Brussels” and speaking ahead of 29 March when he and the UK’s 72 other MEPs were set to relinquish their mandate in the European Parliament, Syed Kamall is keen to speak about matters other than Europe.

-

Opinion Pieces

Opinion PiecesLetter from the US: The $20bn club shifts strategy

The funded status of US corporate defined benefit (DB) plans is getting better, thanks to investment gains and higher corporate bond interest rates that decrease liabilities.

-

Opinion Pieces

Opinion PiecesLong-term matters: Lessons for Climate Action 100+

Fund management is a pretty opaque profession, and no aspect more so than the way investors hold the management of investee companies accountable

-

Features

FeaturesBeyond the annuity waiting room

Fintech is hard to escape in daily life – whether personal finance apps, crowdfunding investments or robo-advisers.

-

Country Report

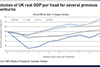

Deficits: All set for a bumpy ride

Choppy markets, economic uncertainity and Brexit are among the issues faced by UK sponsors and trustees

-

Special Report

Special ReportPension tech for dummies

There is no shortage of new technologies that can improve retirement outcomes for pension fund members

-

Special Report

MiFID II: The best is yet to come

By placing stronger requirements on best execution, MiFID II is transforming the execution landscape

-

Features

FeaturesChina tech: Playing BATs versus FAANGs

Chinese tech firms offer exposure to rapidly expanding domestic markets

-

Asset Class Reports

Asset Class ReportsInvestment Grade Credit: Veering between extremes

Capital markets are fluctuating between optimism and pessimism

-

Special Report

Special ReportEuro: Many factors to take into account

Euro-zone investors are not immune to global currency vagaries

-

Features

FeaturesThe euro crisis is not over

The euro’s existential crisis subsided several years ago but it would be wrong to assume it has disappeared. The forces that could undermine its integrity have not vanished.

-

Country Report

Funding: Where do pension funds end?

Identifying the funding horizon means balancing objectives and expectations, particularly given likely prescriptive new funding rules

-

Special Report

UK Financial Reporting Council: On the radar

Reactions to the Kingman review on UK corporate reporting oversight

-

Features

FeaturesMacro matters: Brexit’s challenge for Europe

It is human nature to reduce the complexity of reality to simple rules, simple foci and simple decision points. In this, Brexit is no different