Latest from IPE Magazine – Page 56

-

Features

FeaturesSustainable tourism: consumers need direction

The end of COVID lockdowns in most places has led to a boom in tourism in 2022 and a return to normality that should persist. Before the COVID pandemic, tourism accounted for around 10% of global GDP and 8% of global greenhouse gas (GHG) emissions, according to speakers at the Reset Sustainably conference on sustainable tourism held in London in September. The size of the industry means that moving towards more sustainable development can have a significant, positive impact on the world, both in terms of climate change and in the protection of natural resources, including biodiversity.

-

Interviews

InterviewsDelivering pensions ‘like a Bosch’: Bosch pensionsfonds

Dirk Jargstorff (pictured right), CEO of the pioneering Bosch Pensionsfonds, and Christian Zeidler, CFO, talk to Carlo Svaluto Moreolo on the fund’s 20-year anniversary

-

Interviews

InterviewsMirova’s Philippe Zaouati: realistically optimistic

Asset management CEOs tend to be a clever bunch, but there cannot be many who are familiar with the work of Antonio Gramsci, the 20th century Italian socialist philosopher.

-

Opinion Pieces

Opinion PiecesMeloni grapples with Italy’s pension woes

Reforms usually follow general elections, regardless of the political system. Italy is no different. The most generous country in Europe in terms of pension payments, according to the Organisation for Economic Co-operation and Development (OECD), Italy spends the equivalent of 15.6% of GDP on pensions.

-

Interviews

InterviewsPension funds on the record: Reflections on a sobering year

Pension fund managers reflect on an extremely challenging year for markets and look to the future, considering questions such as what is risk-free, how to secure inflation-linked assets, the role of central banks and the risk of liquidity crises

-

Features

FeaturesAccounting: IASB risks annoying stakeholders

If nothing else, the appointment of Linda Mezon-Hutter to the International Accounting Standards Board promises to bring a much-needed breath of fresh air and dose of reality to the standard-setter’s sleepy proceedings.

-

Features

FeaturesEuropean pension dashboard in the starting blocks

The European Tracking Service for pensions has been years in the making but is now set for a rollout, to be completed by 2027

-

Opinion Pieces

Opinion PiecesGuest viewpoint: The UK pensions sector should be more aggressive on consolidation

UK pension assets across both defined benefit (DB) and defined contribution (DC) funds are too fragmented, and our schemes, even the biggest, are sub-scale. Consolidation is not the answer to everything, but it is a big part of the solution.

-

Features

FeaturesUS dollar strength and the issues facing institutional investors

Most central banks across the world are raising interest rates – some more aggressively than others – but it is proving hard for any of them to out-hike the US Federal Reserve. The resulting widening interest rate differentials have been an important factor in the appreciation of the US currency.

-

Features

FeaturesUK fiduciary managers wrangle with LDI fallout

UK Gilt yields rose throughout 2022, even before September’s well-publicised spike caused by the unfunded mini budget. Fears of global inflation, exacerbated by the energy crisis and geopolitical uncertainty following Russia’s invasion of Ukraine, took UK 10-year yields from around 1% in January to 3% in mid-September.

-

Features

FeaturesFixed income, rates & currency: Recessions - but when?

With the fourth consecutive 75bps hike in rates delivered in November, US Federal Reserve chair Jerome Powell suggested that the pace of the hikes might be slowed in the coming months (so slightly dovish), but then said that the terminal rate and how long it would be held was more important than the speed of tightening (back to hawkish). The initial dollar sell-off was unwound by the end of the press conference.

-

Features

FeaturesAhead of the curve: Recalibrating alternative allocations for a new market

Geopolitics, inflation, and central bank policy have agitated financial markets in 2022, leaving returns and diversification in short supply. A comparison of global equities and bonds provides a sense of just how challenging the results have been.

-

Features

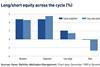

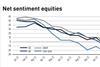

FeaturesIPE Quest Expectations Indicator: December 2022

The Ukrainian offensives look to have petered out and a new initiative will be needed to maintain morale. The US government is once again gridlocked and another debt ceiling fight is likely. The EU seems ready even for a harsh winter, but there are signs of war fatigue. In the UK, Prime Minister Rishi Sunak has apparently learned from the Liz Truss debacle, quickly making the necessary political U-turns, in particular on climate change. Expectations for the COP27 meeting in Sharm El-Sheikh were low. Analyst views indicate increasing belief that the wave of interest rate increases is receding.

-

Features

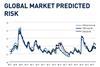

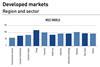

FeaturesQontigo Riskwatch - December 2022

*Data as of 31 October 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Opinion Pieces

Opinion PiecesAustralia: Supers face A$500m tax hit

In the lead-up to the first budget by a Labor government in 12 years, speculation was rife about what the new Australian government might have in store for the superannuation sector.

-

Special Report

Special ReportESG: Joined up thinking required

At last year’s Conference of the Parties, COP26, the financial sector stole the show.

-

Special Report

Special ReportSpecial Report – ESG

Our report looks at the ESG through the prism of private markets, with coverage of SFDR and an interview with Anner Follèr, head of sustainability at Sweden’s national private equity investor AP6

-

Country Report

Country ReportCountry Report – Pensions in Switzerland (November 2022)

Our report on Swiss pensions also looks at the growing demand for so-called 1e plans, additional pension vehicles for higher earners. The 1e sector is ripe for consolidation, like the market for multi-employer pensions (Anlagestiftungen), where the federal regulator is concerned about a build-up of complexity and supervisory risks. We also cover the annual survey of the consultancy Complemeta and assess Swiss pension funds’ asset allocation plans.

-

Country Report

Country ReportCountry Report – Pensions in Spain & Portugal (November 2022)

In Spain, the pension sector is giving a cautious thumbs up to workplace pension reform plans, even if they fall short of the industry’s wish list. Top of that list was mandatory auto-enrolment, which won’t now happen. But the planned national so-called Macro-fondo ‘super fund’ has met with general approval. It will be managed by the private sector but supervised by a control committee comprising government, employer and union representatives.