Latest from IPE Magazine – Page 60

-

Special Report

Special ReportFrom seed investor to prospective investor: the case for ETFs

Investor & manager trends

-

Country Report

Country ReportFrance: The biodiversity reporting enigma

France’s financial institutions must report on biodiversity impacts but face a lack of corporate data push from pension reforms

-

Special Report

Special ReportAsia investment: Japan’s GPIF assesses new strategy

World’s largest pension fund aims improve its allocation to ESG indices following a positive five-year track record

-

Special Report

Special ReportNew kids on the ETF block

Inflows into exchange-traded funds (ETFs) may have taken a hit in the latest bout of market turmoil, but this is not expected to deter new entrants from joining the fray. It is always challenging to break into a new market, especially one dominated by a handful of firms but, those players with innovative, specialised solutions and strategies are expected to make their mark.

-

Special Report

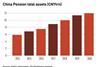

Special ReportAsia investment: China edges closer to a national pension plan

Foreign managers see opportunities in new US 401(k)-style pensions, with vast asset growth potential

-

Special Report

Special ReportHow green are green derivatives?

On 6 April 2022 the European Commission announced that derivatives, including futures, swaps and many other instruments routinely used by ETF providers, cannot be classified as ESG or sustainable or green in investment fund reports.

-

Special Report

Special ReportTo Paris and beyond: capturing energy transition and climate investment opportunities with ETFs

The climate emergency is arguably the greatest challenge of our lifetimes. We must use every tool at our disposal – including financial – to stand any chance of success. Thankfully, investors are ever more aware that incorporating climate in their portfolios can help them manage asset-specific risk, access opportunities from the shift to clean energy and achieve something meaningful with their money. And they are ever more aware they can do it in flexible, cost-effective ways.

-

Special Report

Special ReportAdding to the biodiversity protection toolbox

Biodiversity is intricately linked with economic growth and development. Since the industrial revolution ecosystems have been under constant threat with the advent of large towns, cities and industrial complexes. The rate of deterioration has accelerated over time and we are now destroying natural capital at an unprecedented rate, which will have long-term consequences for economies, societies and the planet.

-

Opinion Pieces

Opinion PiecesSolvency II: Rule changes can’t force risk taking

Changing the rules can often seem like a very sensible policy choice – whether a sweeping deregulatory reform or more of a technocratic adjustment to regulations.

-

Opinion Pieces

Trustees must assess impact of rate hikes

The Bank of England (BoE) has hiked its policy rate by 50bps to 2.25%, prioritising the fight against inflation over support for growth in its domestic economy. This interest rate increase has hit levels not seen since the end of 2008 but in line with a majority of economists’ consensus.

-

Features

FeaturesCan a sinking market re-emerge?

Travelling around Sri Lanka in mid-July reminded me of Winston Churchill’s saying that “democracy is the worst form of government – except for all the others that have been tried”. Many in Sri Lanka would argue that the post-independence history of the country may have proved him wrong. This year, political upheavals after popular demonstrations caused the administration of President Gotabaya Rajapaksa and his elder brother, Prime Minster Mahinda Rajapaksa, to collapse after the Rajapaksas’ deep corruption and deeper ineptitude over two decades brought economic ruin as the country ran out of foreign exchange to pay for fuel imports.

-

Interviews

InterviewsNEST Sammelstiftung: A history of sustainable investing

Ulla Enne (pictured), head of responsible investing and investment operations at Switzerland’s NEST Sammelstiftung, talks to Luigi Serenelli about the pension fund’s central focus on sustainability

-

Features

FeaturesLGIM’s Michelle Scrimgeour: ambitions for growth

Michelle Scrimgeour and her executive team set out their strategic growth priorities in November 2020, a little more than a year after she had taken over as CEO of Legal & General Investment Management (LGIM). They agreed to grow the business by focusing on existing strengths: to modernise, diversify and to internationalise.

-

Book Review

Book ReviewBooks: How liquid are liquid assets?

Amin Rajan speaks to Pascal Blanqué about his latest book

-

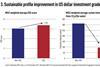

Special Report

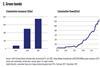

Special ReportWhy investors use sustainable fixed income ETFs

Sustainable fixed income investing is growing at a rapid rate as investors increasingly seek to address climate risks, meet new regulations, and adapt to new investment preferences. The majority of investors who are choosing indexed exposures to build their sustainable portfolios are currently following SRI indices, with 93% of AUM in sustainable fixed income UCITS ETFs tracking such indices.

-

Interviews

InterviewsInterview: Martin Præstegaard, ATP CEO

On the first day of September, Martin Præstegaard – who was installed little more than a month before as CEO of ATP – told journalists in the pension fund’s Copenhagen offices that ATP had made its biggest six-month investment loss ever.

-

Interviews

InterviewsOn the record: Emerging market debt

At a time of high volatility in interest rates, currencies and GDP, two seasoned investors in emerging market debt discuss their approaches

-

Opinion Pieces

Opinion PiecesItaly’s far-right government won’t bring about great changes

The largely anticipated outcome of the Italian election was a strong mandate for the centre-right coalition. This would hardly be a new scenario, were it not for the fact that this time the chosen leader is Giorgia Meloni of Fratelli d’Italia (Brothers of Italy), a right-wing party with historical links with fascism.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Let’s make ESG real, and call out the fakes

Environmental, social and governance (ESG) investing has become pretty much mainstream. At its ideological base is the belief that a capitalist economy and polity that seeks the well-being of its middle class can achieve positive change by mobilising investment flows – in particular, that environmental protection and social justice can come about by correcting where investments are channelled.

-

Opinion Pieces

Opinion PiecesLetter from Berlin: The German way to supervise the EU Taxonomy

The German financial supervisory authority, BaFin, has chosen its own path to deal with the EU taxonomy – in particular when it comes to nuclear and gas.