Latest from IPE Magazine – Page 61

-

Opinion Pieces

Opinion PiecesAustralia: Role for superannuation in nation-building

A new Labor government has set the scene for change in Australia’s growing superannuation industry to ensure that some of the country’s A$3.3trn (€2,3trn) savings pool is directed toward social housing and the energy transition.

-

Opinion Pieces

Opinion PiecesUS: Transparency concerns over SEC private market disclosure rules

Will the US Securities and Exchange Commission’s (SEC’s) new climate risk reporting rules bring more transparency to private markets? Or will they have the unintended consequences of increasing the opacity of the markets?

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Let’s make ESG real, and call out the fakes

Environmental, social and governance (ESG) investing has become pretty much mainstream. At its ideological base is the belief that a capitalist economy and polity that seeks the well-being of its middle class can achieve positive change by mobilising investment flows – in particular, that environmental protection and social justice can come about by correcting where investments are channelled.

-

Opinion Pieces

Opinion PiecesESG Viewpoint: The genius of SFDR - requiring ordinal disclosure is so much more than a label

When the EU originally announced its High-Level Action Plan for Sustainable Growth in 2018, its intended eco-label received a lot of attention. Many considered the Sustainable Finance Disclosure Regulation (SFDR) a boring, administrative matter. Labels are shiny commonplace symbols hyped by corporate marketing teams around the world to instil a feel-good factor in retail consumers and bolster the defensibility of institutional buyer decision making. Required Ordinal Disclosure (ROD) is a technocratic idea whose genius has remained largely unrecognised to date.

-

Features

FeaturesIASB's management commentary project faces identity crisis

Any regular follower of the International Accounting Standards Board is probably familiar with a particular recurring nightmare. It starts with good intentions but spirals into shifting project goals, missed targets, and unquantifiable hours of wasted time. Perhaps you awoke during July to find yourself observing the board’s July discussion of its management commentary project.

-

Features

FeaturesPension funds continue their focus on ESG social issues

Before the year is over, European policymakers are expected to announce their decision to shelve plans for a social taxonomy.

-

Features

FeaturesMarket overview: German institutional investors manage uncertainty

At mid-year 2022, the volume of Spezialfonds – the German vehicle for professional investors – administered on Universal Investment’s platform was €498bn, a rise of around 5% year on year. On a six-month basis, however, and compared with the end of the booming stock year 2021, asset volumes were down around 3%.

-

Features

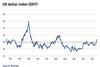

FeaturesFixed income, rates & currency: Central banks act tough

This year’s Jackson Hole Symposium, an annual high-level event sponsored by the Reserve Bank of Kansas, yielded relatively little policy news. But the fighting talk from the US Federal Reserve and others was striking. Fed chair Jerome Powell’s speech was markedly more hawkish than expected, while Isabel Schnabel, board member of the European Central Bank, referred to the need for central banks to act ‘forcefully’ because “both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high”.

-

Features

FeaturesAhead of the curve: Clearing up the ‘scaling’ confusion in carbon intensity

Today, a company’s carbon intensity is typically measured in one of two ways – scaling by revenue, or by EVIC (enterprise value including cash). The choice an investor makes can lead to differences in portfolio characteristics.

-

Features

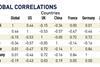

FeaturesQontigo Riskwatch - October 2022

*Data as of 31 August 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator: monthly commentary

Political risk has decreased. An attack in the north-east of Ukraine took the Russian army by surprise but did not cause collateral damage in Russia. Russians’ resistance to the war is mounting but far from a critical level. It looks like the EU will survive the winter without major energy disruption and caps on energy prices are falling into place.

-

Special Report

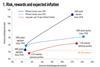

Special ReportInflation: expectations … and reality

In 2022, inflation surprised only on the upside, and surrounding economic conditions became increasingly uncertain. As short-term inflationary pressure has moderately spilled into inflation expectations – 10-year German inflation breakevens rose from 0.5% to more than 2% in 24 months1 – our DWS Long View capital market expectations for the next decade remain below historical averages.

-

Special Report

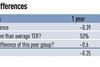

Special ReportActive ETFs: mixed fortunes

Tax efficiency and regulatory change have been the key drivers of the development of active exchange-traded funds in the US. As there are no similar tax benefits nor regulatory change in Europe, growth in this region has been limited.

-

Special Report

Special ReportActive ETFs: five myths debunked

Demand for exchange-traded funds (ETFs) has grown rapidly in Europe in recent years. While much of this growth has been driven by passive funds, research shows that investors are increasingly looking at active ETF strategies. Nevertheless, there are still lots of common misconceptions that are hindering the take-up of active ETFs. Here, we debunk the the most common myths about active ETFs.

-

Special Report

Special ReportGlobal emerging markets index investing: the case for an active component

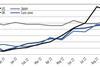

Emerging market (EM) equities have an important role to play in broadly diversified institutional portfolios. Our data analysis shows that for investors who have a buy-and-hold strategy, an active component is needed to stay close to the benchmark because of trading costs and, more importantly, because of higher slippage costs by passive managers in downward markets.

-

Special Report

Special ReportTransparency: getting it taped

It’s much harder for European ETF investors to get detailed information on liquidity, volumes and best execution than it is for their US counterparts. That’s because this data isn’t aggregated into a consolidated tape as it is on the other side of the Atlantic.

-

Special Report

Special ReportCrypto ETFs: exploring the keys to mass adoption

The ProShares Bitcoin Strategy ETF (BITO) made history last October as one of the strongest ever ETF launches, amassing more than $1bn (€1bn) in assets in just two days.

-

Special Report

RFQ platforms and the institutional ETF trading revolution

What do ETFs, RFQ and ESG all have in common? Aside from being some of the most popular acronyms in the history of financial services, the three-letter abbreviations for exchange-traded funds (ETF), electronic request-for-quote (RFQ) trading, and environmental, social and governance (ESG) driven investing, have all come together at the centre of a revolution in asset management.

-

Special Report

Special ReportPost-Brexit flux in Europe

Although Brexit has changed the dynamics of the European asset management landscape, the checklist for choosing a location for an exchange-traded fund (ETF) has not altered: a solid legislative foundation, requisite skillsets, favourable tax treatment and cross-border distribution acumen.