Latest from IPE Magazine – Page 58

-

Features

FeaturesSingle versus double materiality: ISSB faces inconvenient truths

Climate change denial has been a tough ask this summer. Forest fires raged across Europe, part of a London suburb caught light, and hurricane-force winds left a trail of destruction in southern Austria. The doom loop was complete when falling river levels left France’s nuclear power plants battling to produce enough energy to meet the demand for cooling.

-

Features

FeaturesPension funds on the record: how they manage LDI

Pension funds reflect on the role of LDI in their portfolios and the risks associated with an unlikely, but not impossible, sudden rise in interest rates

-

Features

FeaturesThe rising influence of target-date funds on capital markets

One of the fastest growing markets in recent years is the US retirement market. Since 1995, the investment volume has increased six-fold, so that by the end of 2021, the market stood for almost $40trn (€40.1trn) AUM.

-

Features

Features17Capital’s Pierre-Antoine de Selancy: Navigating NAV lending

Pierre-Antoine de Selancy has just left a meeting with his company’s new majority shareholder, Oaktree, and is running a little late. His days are busy. De Selancy is founder and managing partner of 17Capital, a London-based boutique specialised in providing NAV finance to private equity managers.

-

Interviews

InterviewsIrcantec: Aiming for core sustainability

Myriam Métais andCécilia Lyet (pictured) of France’s Caisse des Dépôts talk to Carlo Svaluto Moreolo about managing the reserves of Ircantec, the supplementary scheme for public sector employees

-

Opinion Pieces

Opinion PiecesAn uncertain outlook for UK pension journey plans

Following the Bank of England’s (BoE) emergency intervention announced on 28 September to stem the sell-off of long-dated UK government bonds, UK defined benefit (DB) pension funds were kept busy, as falling Gilt prices over the past weeks caused mark-to-market losses in liability-driven investment (LDI) strategies.

-

Country Report

Country ReportSpain: Industry gives a partial thumbs up to pension proposals

Can Spain’s new workplace pension system work well without auto enrolment?

-

Country Report

Country ReportPortugal: Pension funds navigate uncertain times

Schemes are employing defensive measures to protect against portfolio risk

-

Features

FeaturesUK sovereign debt in turbulent waters as challenges remain

The buttoned-up Gilts market has never seen or done anything like it. Trusty stalwart of liability matching for defined benefit (DB) pension schemes, the blue-chip security has already poleaxed a British chancellor of the exchequer just a month in office, and has effectively done the same to prime minister Liz Truss.

-

Opinion Pieces

Opinion PiecesUS: Pension plans face up to a tough 2022

After the terrible returns of the fiscal year that ended in June, what will US public pension funds do? Will they increase their risky investments to try to reach their target returns? Or will they lower their target returns?

-

Special Report

Special ReportESG: Spotlight falls on ESG executive pay incentives

Executive pay is increasingly tied to sustainability targets and investors want to ensure incentives are properly designed

-

Features

FeaturesThe dynamic feature of SFDR: ‘walking the walk’ benchmarks

Forward-looking information is in high demand among those aiming to invest sustainably. Forward-looking planning of one’s decarbonisation does not mean actually moving forward at the envisioned pace though, unless the penalties for trailing pace are in place and sufficiently painful.

-

Features

FeaturesDistributed work: a novel solution for displaced workers

What COVID has taught the world so dramatically is that knowledge-based companies have been able to function effectively with all their employees working remotely. Location suddenly no longer matters, and many employees have taken advantage of lockdowns to cross borders and work in places they wanted to be in, whether holiday resorts or with family.

-

Features

FeaturesUK LDI woes raise wider European questions

Turmoil in UK Gilt markets has forced continental European pension industries to review their risk management strategies

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Diversification and dislocation in a place called dystopia

What happened to my free lunch? They told me that diversification was there for the taking, yet there has been no zig to my zag. They promised me downside protection, but all I see is red. They said liquidity was a benefit, but never mentioned the bid/ask spread. Welcome to dystopia in the era of dislocation.

-

Features

FeaturesFixed income, rates & currency: The return of extreme volatility

The emergency measures swiftly enacted by policymakers and central banks in March 2020, as we locked our communities, schools and businesses down, unsurprisingly created huge volatility in financial markets.

-

Features

FeaturesAhead of the curve: Beefing up guardrails as risks rise in private credit

For US and European private credit firms, storm clouds are gathering.The recent rate hikes by the Federal Reserve, European Central Bank (ECB) and the Bank of England (BoE)have numbed activity in the leveraged loan and high-yield spaces.

-

Features

FeaturesQontigo Riskwatch - November 2022

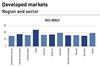

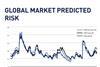

*Data as of 30 September 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

IPE Quest Expectations Indicator - November 2022

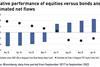

In general, political risk remained the same, except in the UK. The Russian offensive against Ukrainian civil infrastructure is useless. If it should succeed, Russia has no means to exploit it militarily. Ukraine is set to recover Kherson. In the EU, France is trying to cope with a vicious strike that blocks petrol deliveries, but its side effect is a push towards hybrid and non-petrol cars. Japan is worried over implicit North Korean nuclear threats. In the UK political risk has increased fast with a crisis caused by government tax plans that has sapped trust on several levels. The data indicate that analysts believe that the wave of interest rate increases is near (if not over) its top and that bonds are now becoming more attractive than equities for the first time in many years.

-