Dutch pension regulator DNB has reassured pension funds that have grown worried about the impact of changes to their interest rate hedging policies in the wake of the Dutch pension transition.

“Multiple large transactions in a short time could lead to temporary stress, but we see various tempering factors,” according to DNB.

In the next 14 months, the large majority of Dutch pension funds are set to move to a new pension contract, involving a switch from defined benefit (DB) to defined contribution (DC) arrangements. In the process, many funds will reform their interest rate hedges.

For younger members, most funds will reduce allocations to government bonds and interest rate swaps – low-risk instruments offering fixed returns – and increase exposure to higher-risk assets such as equities, aiming for long-term growth.

For older workers and pensioners, pension funds will maintain a strong focus on government bonds and interest rate swaps to ensure stable benefit payments.

The older the member, the shorter the maturity of these investments. On balance, this suggests a likely reduction in investments in long-term (≥25 years) government bonds and interest rate swaps under the new pension contract.

Reducing holdings in govvies, swaps

Based on market analyst expectations, DNB estimates that pension funds will reduce their holdings in government bonds and interest rate swaps with a maturity of 25 years and longer by roughly €100-150bn.

As a comparison: total outstanding governments (including supranationals) with a duration above 25 years in the euro zone amounts to €900bn, according to DNB.

Originally, pension funds were required to implement their new policies before moving to their new DC arrangements. However, the Dutch government recognised this could lead to a strong market impact as this would mean that many pension funds would be trying to sell longer-term securities at the same time, potentially leading to a large market impact.

Dutch pension funds own approximately 20% of all Dutch government bonds, and 10% of Germany’s.

Therefore, former minister of social affairs Eddy van Hijum approved a 12-month window for pension funds to review their interest rate hedges after their transition to DC. This measure is likely to lead to a dispersion of transactions, reducing market pressure, DNB noted.

Secondly, there are also uncertainties surrounding the ultimate decline in demand for long-term interest rate instruments.

“Many pension funds only provide an indicative overview of their planned investments, and some funds have yet to finalise their strategies. Developments in financial markets also play a role. The funding ratio on the transition date will influence how assets are allocated across member groups, shaping the aggregate investment policy. In addition, the scale of required adjustments may grow if funds choose to increase interest rate hedging to protect their funding ratios prior to the transition. These factors make it difficult to predict the final impact on investment allocations,” according to the regulator.

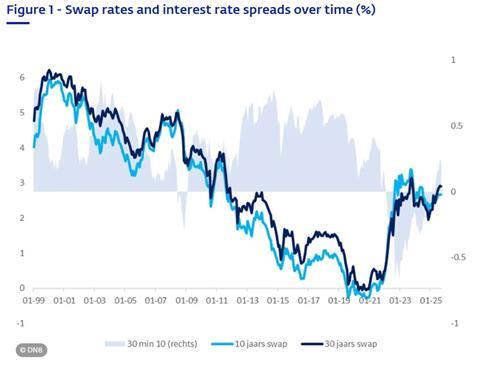

Finally, DNB noted that 30-year rates have risen faster this year than 10-year rates (see chart below), as investors such as hedge funds are anticipating the pension transition and are trying to front-run expected trades.

However, there are more factors at play explaining this development, according to the regulator, “such as increased government spending and rising debt levels”.

In this regard, DNB noted that the spread between 30-year and 10-year rates is currently higher in Japan and the UK than in the Netherlands.

“If the spread widens further, market incentives will emerge to rebalance supply and demand. For example, governments may favour issuing shorter-term bonds, and the cost of 30-year fixed-rate mortgages could also rise relative to 10-year mortgages, making the former more expensive for consumers.

“We expect liquid European interest rate markets to absorb the extra supply of interest rate instruments and gradually find a new equilibrium,” DNB concluded.

Read the digital edition of IPE’s latest magazine