Sweden’s investment funds lobby has criticised the country’s Fund Selection Agency (Fondforgsnämnden, FTN) for aspects of the way it conducted its first procurement for funds to be offered on the reformed premium pension platform – as well as the original political decision to move to a procured model.

The FTN, which was formed in 2022, announced the results on Monday of its first tender, with six firms granted fund agreements for actively-managed large/mid-cap European equity funds.

Fredrik Nordström, chief executive officer of the Swedish Investment Fund Association (Fondbolagens förening) said: “The Fund Selection Agency believes they have now selected the best funds. It is far from a foregone conclusion.”

“Several funds are excluded due to rigid procurement criteria and cannot even submit tenders,” he said in a statement on Monday.

Funds were excluded, he said, because they were traded in the ‘wrong’ currency, managed by a small fund company or had a different investment or sustainability strategy.

“The authority has also valued a number of different characteristics that are not obviously related to quality, and it is also not certain that they are valued as highly by pension savers,” said Nordström.

The construction of the tenders limits competition and reduces the supply of good funds for fund savers to choose from, according to Nordström.

“The agreements that are signed are six to 12 years long, which means that the fund range within the defined category is locked during this time,” he said, adding: “Funds that prove to be better will not benefit savers until the next procurement opportunity at the earliest.”

The association has been critical of the change to a procured funds platform from the start, for a range of reasons.

Nordström said his association is keen that the premium pension system maintain a high quality and that its savers should be offered freedom of choice among monitored quality funds.

“It is regrettable that many years of negligence by the Financial Supervisory Authority and the Pensions Authority in terms of control and supervision have led to a political overreaction in the form of a rigid procurement process,” the CEO said.

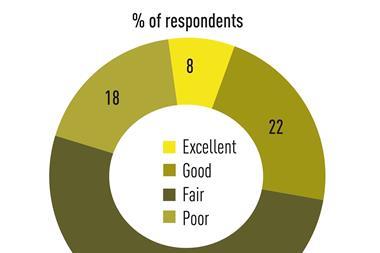

The lobby group said in its statement that the allocation decision by the FTN means the number of funds in the European equity category is being reduced from 22 to six.

However, the FTN has said in its procurement report that more than 92% of the assets in the category was placed in the six largest funds, with the remaining 16 funds holding less than 8% of the assets between them.

Read the digital edition of IPE’s latest magazine