GastroSocial Pensionskasse, the CHF11bn (€11.47bn) pension fund for Switzerland’s hospitality industry, is set to anchor the senior tranche of Allianz Global Investors’ new $1bn blended finance fund for emerging markets, alongside Allianz SE.

The Allianz Credit Emerging Markets fund, launched this week at British International Investment (BII) in London, has reached its first close of $690m and is targeting a final close of $1bn. The fund will support Paris Agreement goals with a focus on climate finance.

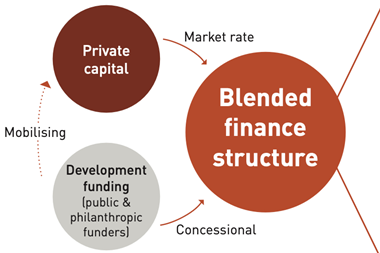

It will use a blended structure to attract more institutional capital into emerging market lending. Allianz GI said that about $150m of concessional capital will sit in a junior tranche provided by development finance institutions (DFIs) and multilateral development bank partners (MDBs).

This is designed to reduce volatility for private investors, who could provide up to another $850m if the final close target of $1bn is reached.

Speaking to IPE, Beat Wüst, chief investment officer and head asset management at GastroSocial Pensionskasse, said the decision to anchor the senior tranche of the Allianz fund is due in part to the Swiss fund’s long history of investing in emerging markets on the public side as well as in select private market strategies.

“We have been investing through blended finance structures for more than 10 years and do have significant investments in private credit in developed markets. Through these activities, we accumulated a broad experience in this field over many years.”

“Having a number of globally relevant de-risking parties supporting the [Allianz fund], not just financially, but also through their network, experience and standing, gave us confidence in the strategy. In addition, with Allianz investing a significant amount from their insurance balance sheet provided a high level of security in terms of alignment of interest,” he added.

The UK’s DFI, BII, is committing $40m to the junior tranche, alongside Global Affairs Canada, the development agency of Canada, the Inter-American Development Bank Invest, the Swedish International Development Cooperation Agency, and Impact Fund Denmark.

Climate finance

Edouard Jozan, head of private markets at AllianzGI, said that addressing climate change cannot be focused solely on investing in developed markets, adding that launching the fund is a step forward in mobilising institutional capital to address global development priorities, including climate.

“This strategy is a great example of the strength and power of collaboration between the public and private sectors and the significant potential for further scale in this asset class. Leveraging our longstanding partnerships with DFIs and MDBs, we aim to deliver investors with both attractive returns and measurable positive outcomes,” said Jozan.

A significant percentage of the disbursements from the fund is intended to be made in Africa, with the remainder allocated across other emerging economies. It plans to invest across sectors, including renewable power, clean transport, agriculture, and financial services, positioning itself among the larger blended finance vehicles raised to date, according to BII.