All IPE articles in October 2018 (magazine)

View all stories from this issue.

-

Special Report

Spezialfonds: Assets approach €1.5trn

Securities Spezialfonds assets are approaching a €1.5trn high water mark

-

Special Report

Implementation: Five myths about ETFs debunked

Over the years, exchange-traded funds (ETFs) have attracted their fair share of criticism from market participants, regulators and investors

-

Features

Accounting Matters: Drawing a line in the sand

Standard setters’ focus on risk-sharing pensions recalls previous abandoned attempts to reconcile non-DB and DC accounting approaches

-

Special Report

Special ReportImplementation: The future is active

While passive ETFs continue to dominate flows, active ETFs are one of the factors that will drive further growth in the sector

-

Special Report

The market: M&A activity in European ETFs

The European ETF industry is still relatively youthful compared with its US counterpart, but already there have been significant mergers and acquisitions

-

Special Report

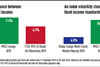

Factor investing & smart beta: Advances in factor-based fixed income indices

Global fixed income investors have benefited from a long bull market that began in the early 1990s

-

Features

FeaturesAhead of the Curve: Trends to heed in renewables

Big data and predictive analytics are two developing trends that can dramatically improve how renewable energy investments are made

-

Opinion Pieces

Opinion PiecesLetter from Brussels: Focus on pension products and supervision ahead of elections

Tensions are rising in Brussels as the EU institutional mandate approaches its end ahead of the Parliamentary elections in May 2019, and the Commission has already ceased issuing new proposals in the absence of legislative time.

-

Features

Fixed income, Rates, Currencies: America leads the way

Emerging markets have endured a difficult summer. Market sensitivities were heightened by fears of a trade war and the reality that the US Federal Reserve will keep raising interest rates. The flashpoints in Argentina and Turkey have focused attention on the EM universe, particularly the more vulnerable economies with less healthy fundamentals.

-

Analysis

Portfolio Analysis: Back to the old world

Universal-Investment’s Spezialfonds data shows how German institutional investors are navigating the current market environment

-

Special Report

Special ReportGerman Asset Management: A larger appetite for ESG

How German asset managers are taking up the cudgels as demand for ESG approaches continues to grow

-

Asset Class Reports

Small Cap Versus Private Equity: Separate arguments

Comparisons of the performance of listed smaller companies and private equity are fraught with difficulty

-

Special Report

Special ReportSpecial Report Asia: Game-changer

China’s growing clout in Asia is influencing investment strategies across the region

-

Features

FeaturesTime to beef up UK supervision

With assets of in excess of £1.8trn, DB occupational pensions easily represent the single largest stock of financial savings in the UK

-

Special Report

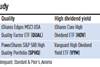

Special ReportFactor investing & smart beta: What’s in a name?

Many smart beta ETFs are bought with the expectation of long-term market outperformance. The factors that many are based on have been proven both academically and empirically to produce excess returns

-

Special Report

Special ReportFactor investing & smart beta: The smart beta (r)evolution

The ability of stocks with certain investment characteristics to outperform the market has been well understood and documented for decades. But options of how to implement this strategy were limited

-

Features

Chinese Bonds: Too big to ignore?

Recent tax reforms and the expected inclusion in global indices of Chinese sovereign bonds has shone a spotlight on a vast, under-exploited, multi-trillion bond market

-

Features

Briefing: How to model a trade war

So how does one model the effect of further tariffs on a portfolio? This article shows how to construct a potential trade-war scenario and analyse the impact on a euro-denominated global multi-asset class portfolio

-

Special Report

ESG: Building impact and values into portfolios

Exchange-traded funds that prioritise environmental, social and governance matters have grown exponentially in popularity over the past few years

-

Interviews

On the Record: Small Caps

We asked the senior managers of two European pension funds to describe how they invest in small-cap equities and what are the challenges and opportunities in this asset class