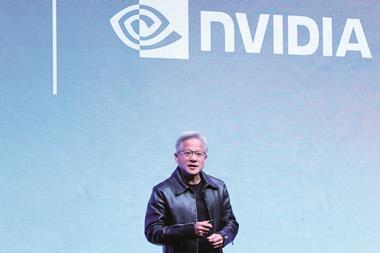

Michael Pedroni

Global asset managers are under more public pressure than ever, as policymakers in disparate regions demand that fund managers fulfil multiple and often conflicting roles.

Everyone agrees that asset managers should offer investment solutions that contribute to retirement security. But many policymakers are now also pressing asset managers to underwrite domestic economic and military priorities.

And, in Europe, there’s added pressure on asset managers to back the transition to climate neutrality.

These are big demands, and many asset managers have responded by attempting to serve many masters. In practice, this means firms are attempting to operate as a global business on the commercial side while staying siloed and regional in their engagement with regulators and politicians.

But this approach is no longer working, with massive new business risks emerging. Dutch pension funds are choosing to end mandates for American firms, and European firms in the US are under increased scrutiny.

In addition to lost investments, global firms that fail to modernise their public and regulatory engagement will slowly undermine their brands and reputation, confusing and angering public officials and customers who are told one thing but then notice that the same firm is saying something quite different in another region of the world.

They say all politics are local. But the asset management business is global. The core dilemma is: how can asset managers reconcile this local/global tension?

The answer is that firms will have to make a fundamental shift, making sometimes tough decisions to globalise their public engagement and align it with their commercial strategies.

Here are a few more fundamentals to begin with when crafting a fresh strategy.

First, recognise that the goal of capital markets vitality and growth is a shared concern across jurisdictions, and that capital markets only function well when they are open and global. Align advocacy accordingly. Don’t fall for calls from inward-looking policymakers that want to trap capital inside their borders.

At the same time, it’s important to recognise that leaders around the world are looking to strengthen their economies and find more revenue to fund the expensive task of governing their societies. Asset managers have a compelling case to make for how they build capital markets and boost economies.

In Europe, for example, firms should present well-grounded case studies that demonstrate a positive impact on regional and national economies, paired with simple and clear proposals for what more regulators could do to foster investment.

Second, given the importance of the Transatlantic market, each firm’s European leaders should spearhead an effort to select, train, and deploy more of its senior American leadership in dialogues with European policymakers, and vice versa. Both sets of leaders would benefit from a deeper, more nuanced understanding of these two different terrains. Doing so would strengthen a firm’s global engagement and lead to more skillful navigation of the policy differences.

Finally, look for common ground amidst divergence.

ESG is a prime example. Many asset managers have softened or toned down their rhetoric and pulled out of certain climate organisations, but that doesn’t mean they’re not still managing funds focused on environmental, social, and governance goals.

Funds should be unapologetic when they are simply responding to market demand: if a client seeks a fund aligned with ESG goals, the manager serves the investor (and not the state). Funds should also make the ROI clearer that these funds are delivering.

Calling on these facts to dispel myths and reinforce the manager’s sustained commitment to serving investors will help inform the dialogue with European regulators.

These steps will be helpful, but it would be naïve to say these conversations will become smooth and easy.

Asset managers must keep first principles in mind. The path forward for them is to engage with authentic, consistent communication about what serves investors best. That is a global strategy – and one that works in every local context.

Michael Pedroni is founder and CEO of Highland Global and a former US financial affairs attaché to the European Union

Net Zero: Front Line Dispatches

The vast majority of countries have missed their deadlines for setting new emission reduction targets under the Paris Agreement. last-minute announcements before this year’s Belém COP, however, mean that there is now a critical mass of new nationally determined contributions.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

Currently

reading

Currently

reading

Michael Pedroni: “The path forward for an asset manager is to engage with authentic, consistent communication about what serves investors best”