Susanna Rust

Regular contributor

News

NewsGenerali AM’s François Humbert calls for GIPS for investor engagement

A global standard like the one for reporting investment performance could help asset owners incentivise more effective corporate engagement

News

NewsEFAMA sets out requests for Commission omnibus initiative

Asset management body’s board discussed the heavily anticipated initiative at a meeting on Wednesday

News

NewsFrance’s FRR ramps up equities as investment horizon extended

Pension reserve fund estimates a median €1.8bn in extra value creation by 2033

News

NewsPEPP ‘failure’ fix and other pension priorities for new EU cycle

PensionsEurope also says pension funds ‘increasingly and incorrectly framed by EU legislation as providing products sold to consumers or customers’

News

NewsPensionsEurope ‘deplores’ undifferentiated EIOPA greenwashing approach

Industry body also said it fears EIOPA’s proposed stance could lead to greenhushing

News

NewsFinance groups call for delay of SFDR technical changes given broader review

Efama, together with banking and insurance associations, pleads for coordination between RTS adoption and overarching review of SFDR

Opinion Pieces

Opinion PiecesReasons to be cheerful in ESG-land

In 1979 Ian Dury, an influential British musician, released a song called ‘Reasons to be Cheerful, Pt 3’, which quickly became a classic. Let us consider why the world of environmental, social and governance (ESG) investing offers grounds for good cheer in the year ahead, even if it is not as rousing as the song.

Analysis

AnalysisSustainable finance: outlook and trends for 2024

Transition finance is expected to be one significant theme in 2024 as net-zero regulations come into force

News

NewsPension funds call on ISS to step up on climate proxy voting advice

Investors raise concerns about inconsistencies and lack of specific net-zero policy in IIGCC-coordinated letter

News

NewsESG roundup: Just eight get top Morningstar commitment mark

Plus: ISS benchmark policy survey; More UK Stewardship Code signatories; MSCI pursues generative AI solutions

News

NewsTNFD to develop blueprint for public pool for nature-related data

Data ‘should not be kept behind paywalls or in proprietary systems’

Features

FeaturesSeeking clarity as stakeholders shine a light on ESG ratings

There is confusion about the objectives of ESG ratings and any regulation needs to be clear about what it is trying to achieve and for whom

Country Report

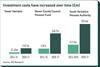

Country ReportUK: Behind the pooling figures for local government pensions

Comparing the cost savings of the eight local government pension scheme pools is a complex exercise

News

NewsEC follows through with derivatives exclusion in final SFDR RTS

Exposures through derivatives not allowed to be reported as sustainable elements of strategy

- Special Report

SDG reporting: Beyond SDG-washing

Only thorough processes and due diligence can make sense of the welter of claims and frameworks by companies using the SDGs as a reporting tool

- Special Report

Manager Selection: A new guide to the future

Past performance is an unreliable guide to future success. Might the corporate culture of asset managers offer better foresight?

Features

FeaturesShare buybacks: Bringing it back in-house

The corporate policy of share buybacks received a boost with the US tax cut, but are they an efficient use of excess capital or a means to further enhance executive remuneration and entrench societal inequality?

- News

Lawyers warn on political influence over public funds after UK court ruling

Palestine Solidarity Campaign to consider appeal against court decision

- News

Carillion: Trustee chair quizzed over pension contribution deferrals

Robin Ellison told a parliamentary enquiry that the trustees had been in “robust” negotiations with Carillion for years