All IPE articles in April 2016 (Magazine) – Page 2

-

Features

Commodity Prices: If only we could blame China

Niels Jensen argues that the strong dollar and rising debt levels among emerging market corporates bear some of responsibility for the slump in global commodity prices

-

Features

Diary of an Investor: Muddy boots on

We pension funds at least have the luxury of not being stuck behind our screens all the time, trading or monitoring our portfolio

-

Features

Breaking Germany’s mould

Federal civil servants at two government ministries are searching for a workable policy to promote occupational pensions

-

Asset Class Reports

Heading for the Brexit?

The possibility of the UK voting to leave the EU is causing considerable uncertainty among asset managers

-

Special Report

Portfolio Construction: Calculated risks

Factor investing promises to outperform both passive and active management. Carlo Svaluto Moreolo discusses the issue of implementation

-

Features

CEE equities – Middle ground promise

David Turner assesses why Central and Eastern European equities are catching the eye of many investors

-

Features

The ceiling has no fans

The International Financial Reporting Interpretations Committee (IFRIC) has proposed potentially far-reaching changes to its asset-ceiling guidance. The proposals have their fair share of critics

-

Country Report

Interview: Karl Timmel CEO, VBV

Karl Timmel, CEO of Austria’s largest Pensionskasse, VBV, helped to set up the second pillar in the country more than two decades ago

-

Features

FeaturesUK Local Government Pensions: Choose your partner

After years of debate, concrete details regarding the future of the UK local authority pensions sector are emerging

-

Opinion Pieces

Long-Term Matters: A climate culture clash

The Netherlands and the US are both free-market countries with thriving financial industries. But they also are very different and this is an unrecognised risk for large US mutual fund managers.

-

Features

Focus Group: Risk-factor investing concepts

Just over half of the investors polled for this month’s Focus Group currently allocate assets to strategies that employ risk-factor investing concepts

-

Special Report

Special ReportThe French quant connection

Brendan Maton explores the pre-eminence of engineering in French elite education and the extent of its success in application in asset management

-

Special Report

Special Report: Consultants under scrutiny

The UK’s Financial Conduct Authority is carrying out a comprehensive review of the asset management industry, which reaches to the heart of investment consultants’ business models

-

Features

Investment: Convex protection

With record-low corporate spreads and volatile equity markets, is it time to take a closer look at convertible bonds?

-

Country Report

Corporate Pensions: A shift in risk perception

Corporate pension schemes need to change the status quo in terms of governance and implementation if they are to meet their goals, writes Nigel Cresswell

-

Features

FeaturesCross-Border Pensions: Dutch in first Malta DC set-up

Plegt-Vos is the first Dutch company to relocate a defined contribution plan to Malta.Maarten van Wijk reports

-

Special Report

Investment Options: Deciding factors

Investors looking to enter the world of factor investing are faced with an array of products from simpler beta strategies to actively managed quant funds

-

Asset Class Reports

Equity markets slow down

The European equity market has surged in market capitalistion since 2009, but not necessarily because company earnings have increased.

-

Features

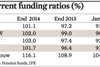

FeaturesDutch Funding: Facing a painful squeeze

Dutch pension funds’ nose-diving coverage ratios underline just how futile various measure have been in improving funding and minimise rights cuts

-

Opinion Pieces

Letter from the US: The Yale effect

Good things come in small packages. It sounds so true reading the latest annual National Association of College and University Business Officers (NACUBO) Commonfund study of endowment performance.

- Previous Page

- Page1

- Page2

- Page3

- Next Page