All IPE articles in April 2020 (Magazine)

View all stories from this issue.

-

Interviews

InterviewsHow we run our money: AP2

Lars Lindblom (pictured), global fixed-income manager at the second Swedish buffer fund, talks to Carlo Svaluto Moreolo about the fund’s evolving green bond investment strategy

-

-

-

Features

FeaturesIPE Quest Expectations Indicator: April 2020

This months’ figures were collected before the successive stock-market slumps.

-

Analysis

AnalysisPensions accounting: IASB faces disclosure tussle

The story of the latest work by the International Accounting Standards Board (IASB) on pensions disclosures starts last July when the board agreed on two specific disclosure amendments that it wanted to make to International Accounting Standard 19 (IAS 19), Employee Benefits.

-

News

Pensions Briefing: Incorporating ESG factors in pension investment activity

A look at IOPS supervisory guidance on the integration of ESG factors in the investment and risk management of pension funds

-

Features

FeaturesFixed Income & Credit: Potential for adventures

Emerging-market local-currency corporate debt is under-explored by global investors

-

Opinion Pieces

Opinion PiecesLong Term Matters: Investing in an age of pandemics

Pandemics are master classes in managing existential uncertainty. Being overwhelmed is ‘normal’. Here are seven actions that we can take as citizens and investment professionals. The focus is on the US and the UK: their governments are floundering. The unravelling in the US is dangerous for investors. Both the UK and the US are very responsive to the financial sector.

-

Country Report

Country ReportGermany & Austria: ESG and alternatives rise up the agenda

German pension funds are embracing ESG and alternative assets in the search for improved yield

-

Opinion Pieces

Opinion PiecesLetter from US: The Democratic agenda takes shape

“On day one, [Joe] Biden will use the full authority of the executive branch to make progress and significantly reduce emissions. Biden recognises we must go further, faster and more aggressively than ever before, by (among other things) requiring public companies to disclose climate risks and the greenhouse gas emissions in their operations and supply chains.” That is Joe Biden’s ‘Plan for a Clean Energy Revolution and Environmental Justice’ as it appears on joebiden.com, the official campaign website.

-

Features

FeaturesAhead of the Curve: The mega-cap conundrum

Last year was challenging for quantitative equity strategies with a large proportion of them underperforming their benchmark on a rolling one-year basis. There has, therefore, been a great deal of interest in understanding the shortcomings of quantitative portfolios over the same calendar year.

-

Special Report

Special ReportDashboard tech: How AI can transform pensions

Dashboard technology like Moneyhub has the potential to prompt consolidation in UK DC pensions

-

Interviews

InterviewsUK auto enrolment: The architecture of a reform

The UK’s auto-enrolment policy has been successful. But this success has been no accident, as a new research project shows

-

Special Report

Special ReportStrategically Speaking: HSBC Global Asset Management

As the financial markets enter uncharted territory, HSBC GAM could be well placed to take advantage of the dislocations in Asian and emerging markets. Its aim, though, is to offer investors the full spectrum of fixed-income solutions, says Xavier Baraton, global CIO for fixed-income private debt and alternatives.

-

Country Report

Country ReportGermany & Austria: Do social partners pensions have a future?

The implementation of social partner pensions between employer and trade unions has yet to take off

-

Country Report

Country ReportAustria: Time to step up

The new coalition government faces a difficult challenge in delivering long-anticipated occupational pension reform

-

Features

FeaturesResearch: The new benchmarks

Sustainability is set to become the gold standard of investing

-

Special Report

Special ReportGreen bond issuance: Denmark's split offering

The Danish government is keen to employ tradeable green certificates, which are designed to broaden the appeal of environmental debt, in its initial green bond issuance

-

Special Report

Special ReportTransition bonds: Questions of transition

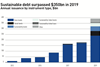

The market for sustainable investments is growing exponentially

-

Interviews

InterviewsOn the record: Green bonds

IPE asked two Nordic pension funds how they invest in green bonds and to what extent sustainability is considered part of their fixed-income strategies