Asia – Page 2

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

News

NewsInstitutional investors see geopolitical bad actors as 2024 economic threat

Institutional investors have ‘good reason for concern’ as the geopolitical landscape is looking ‘less stable going into 2024’, says Natixis research

-

Asset Class Reports

Asset Class ReportsJapanese stock market finally lives up to expectations

Stocks rally, helped by rising inflation and corporate governance reforms

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Asset Class Reports

Asset Class ReportsLocal currency emerging market bonds are back in the spotlight

Partly thanks to the weakening of the US dollar, local currency emerging market sovereigns are now offering healthy yields, and should continue to perform well

-

Special Report

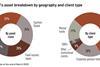

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky

-

Special Report

Special ReportHow investors are positioned to capitalise in APAC private markets

Strong fundamentals and a lack of correlation with western markets make the region particularly attractive

-

Special Report

Special ReportAsia Investment - Special Report

In this month’s special report on Asia, IPE’s private markets editor Lauren Mills analyses why global institutional investors are setting their sights on Asia. The combination of strong fundamentals and a lack of correlation with the European and North American economies make the region’s private assets particularly attractive. Investors are particularly hungry for infrastructure assets as well as the region’s fast-growing digital infrastructure.

-

Special Report

Special ReportSumitomo Mitsui Trust's Yoshio Hishida on Japan's unique position to attract investment

Yoshio Hishida, CEO of Sumitomo Mitsui Trust Asset Management, one of Japan’s largest investment managers, talks to Christopher Walker about his company’s focus on retail and attracting international capital

-

Special Report

India forms cornerstone of GIC’s BRIC portfolio

The Singaporean sovereign wealth fund has invested billions in the subcontinent since the 1990s and considers the country under-invested

-

Interviews

InterviewsNikko Asset Management: Complex, creative thinking

Stefanie Drews is at home with complexity. She speaks several languages fluently, including Japanese, and tells us she still does her maths in Italian.

-

Special Report

Special ReportSpecial Report Asia: Game-changer

China’s growing clout in Asia is influencing investment strategies across the region

-

Special Report

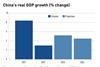

China: No escaping China’s reach

China is influencing the investment world in numerous unexpected ways as a result of its large and growing economic weight

-

Special Report

Markets: Degrees of development

Asian markets range from frontier and emerging to developed economies

-

Special Report

India: Promising signs for the future

Recent economic reforms and structural changes have created a positive outlook for India

-

Special Report

Special Report – Asian Private Equity

Conditions underfoot are heavy for private equity investors, both in China and elsewhere in Asia, writes Simon Osborne.

-

Special Report

Special Report – ETFs in China

Orlando Bowie looks at the growth trends of exchange-traded funds in China.

-

Special Report

Special Report – ETF Roundtable

IPA’s ETF Roundtable was held in Hong Kong and featured:

-

Special Report

Absolute Asia

Asia hedge funds still run less money than before 2008, but they increasingly do so locally and in a broader range of strategies. Shirin Ismail and Tricia Sum survey how the industry is evolving to meet the needs of Asian and global institutional investors

-

Special Report

Moving ahead – despite the government

Investors were heartened by 2012’s burst of reform in India, but Joseph Mariathasan writes that this is an unexpected bonus in a market where the dynamism comes from the private sector

- Previous Page

- Page1

- Page2

- Page3

- Next Page