Asset Allocation – Page 39

-

Features

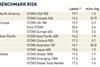

FeaturesQontigo Riskwatch - May 2022

* Data as of 31 March 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator commentary May 2022

Ukraine is slowly gaining the upper hand, while Russia is still unwilling to make concessions. Putin is trying to play his nuclear card, a dangerous move, making himself the major obstacle to stopping the appalling Russian losses in people and equipment. Meanwhile, Zelensky lost points by creating an issue with Germany when he can’t afford to lose points.

-

Features

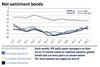

FeaturesFixed income, rates & currency: Markets grapple with inflation and slowdown

The global outlook for economic growth is deteriorating, with repeatedly revised economic forecasts pointing to ever-higher inflation and lower GDP growth. The far-reaching impacts of the Russia-Ukraine war, moving principally through energy and commodity channels, have exacerbated so many of the world’s existing pandemic-related supply-side bottlenecks, which had been gradually easing in the weeks and months before Russia invaded.

-

Asset Class Reports

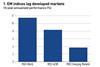

Asset Class ReportsEmerging markets: Global or local?

For emerging market strategies, it is difficult to establish a clear link between performance and local presence

-

News

NewsElo CEO says war seems to have hit several Finnish companies hard

Finnish pension insurers Elo and Veritas post negative Q1 returns of 1.9% and 3.5% respectively

-

News

Dutch pension funds may not increase risk during pension transition

They are likely to postpone making changes to their strategic asset allocation until after the transition

-

News

Swiss pension schemes post high returns with alternatives

Private equity delivered the best absolute return of 45.44% in 2021 at Asga Pensionskasse

-

News

Norway’s SWF loses 4.9% in Q1 but beats benchmark

GPFG sees inflow of NOK141bn as oil prices climb

-

News

Norway mulls next steps as domestic SWF hits ownership cap

Government plans to open Tromsø office to ‘build strong asset management environment’ in country’s north.

-

News

NewsNorway doubles SWF’s scope for unlisted renewable infra to €25bn

Finance Ministry publishes annual white paper on Government Pension Fund

-

-

Features

IPE Quest Expectations Indicator commentary April 2022

With a threat of nuclear war looming, Russia increasingly looking exhausted and desperate but unwilling to make concessions and a Russian default threatening, the world is again as dangerous as it was during the cold war. A default now cannot be compared with Russia’s de facto default in 1998.

-

Features

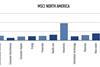

FeaturesUkraine & Russia: Asset allocation and investing in a time of war

It is a well-known fact that geopolitical events have no lasting impact on financial markets. However, Russian president Vladimir Putin’s decision to wage war on Ukraine has forced institutional investors to reassess their strategies. While stock market indices tend to recover fairly soon after the initial shock of a geopolitical event, the conflict between Russia and Ukraine has potentially wide-ranging consequences beyond a sudden spike in volatility.

-

Features

FeaturesFixed income, rates & currencies: War and inflation dominate

While we watch horrible scenes of towns and cities under bombardment, their bewildered and bloodied citizens desperately searching for safety, the huge shockwaves generated by the Russian invasion of Ukraine are spreading rapidly far beyond both countries’ borders.

-

Interviews

InterviewsUkraine & Russia: War-proofing portfolios

Investors react to outbreak of hostilities and reflect on asset allocation in the months ahead

-

News

Russian losses for Nordic pension funds unclear, but allocations small

Denmark’s IPD says pension funds’ Russian, Belarusian investments diminished to DKK2bn in March from DKK9.2bn end 2021

-

News

Major investors see need for portfolio construction rethink – survey

Nuveen and Robeco publish results of institutional investor surveys

-

News

Pension funds in Nordics stick with China exposure but alert to risks

KLP’s Koch-Hagen says geopolitical shifts could make China a greater source of diversification - or else a riskier investment

-

News

NewsFinnish pension insurers’ solvency stronger despite higher equity allocations

Pensions lobby TELA says strong solvency now needed, because it’s unclear how long war will last, or what the economic effects will be