Asset Allocation – Page 40

-

News

Norway’s SWF submits plan to divest zero-value Russian assets ‘over time’

NBIM proposes adjustments to GPFG’s mandate to reflect the removal of Russia from fund’s investment universe – but does not disclose details

-

News

Pension schemes move to sell Russian assets amid trading obstacles

UK’s USS, NEST and BTPS, in addition to Publica in Switzerland and Bpf Bouw in the Netherlands have all decided to divest from Russian assets

-

Features

FeaturesQontigo Riskwatch – March 2022

* Data as of 31 January 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesIPE Quest Expectations Indicator – March 2022

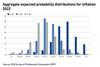

Political risk is back. Russian aggression towards Ukraine inserts considerable amounts of uncertainty. Asset owners will in general not suffer significant direct consequences for a well-diversified portfolio, but there are potential implications for energy prices that come at a time when inflation was already making a comeback and on top of unexpected military expenditure when budgets are already charged by COVID-19-related outlays

-

-

Features

FeaturesAhead of the curve – Late-stage growth: a growing priority in PE portfolios

With additional options to fund growth outside of an initial public offering (IPO), start-ups are staying private longer. The average age at which venture capital-backed companies go public has increased from about 4.5 years during the 1990s to about 6.5 years today.

-

Country Report

Country ReportInvestment strategy: Asset allocation at a time of uncertainty

Senior investment figures give their views on asset allocation

-

Features

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

News

AP4 says equities, real assets drove 19.2% return; aims for more RA

Swedish buffer fund leads peers with SEK528bn assets under management at end 2021

-

News

AP7 narrowly beats premium pension private firms with 31.5% return

State-run default provider puts higher return down to younger saver profile, in part, but also private equity, risk premia gains.

-

News

NewsSwedish buffer funds: AP3 posts 21% while PE-only AP6 returns 49%

Listed equities, alternatives and krona weakness power returns in 2021, says AP3

-

News

USS sees new £500m private markets move as net-zero help

University scheme announces interim net-zero targets

-

News

ATP gives highest-ever pensions hike, but sees lower returns ahead

Nearly half of the geared investment portfolio return came from inflation-linked instruments in 2021

-

News

NewsAMF generated 34% equities return amid portfolio restructuring

Blue-collar pension fund reports increase in solvency to 232% from 196%

-

News

Real asset strategies pay off for Swiss institutional investors – study

Foreign equities recorded the highest increase in value in 2021 with 26.1%

-

News

Veritas CIO says investors must challenge core allocation beliefs in new era

Finnish pension fund has reduced interest-rate sensitivity in fixed-income portfolio, says Vatanen, but worries about equity and alternatives

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2022

Wait and see

Omicron surprised a world that thought COVID was almost over. Infections shot up in the EU, UK and US, reaching all-time highs, especially in France. However, while absolute levels remain high, the curves have turned and panic is abating. Death rates were little affected. -

Features

FeaturesFixed income, rates, currencies: COVID starts to lose grip on GDP

COVID’s huge influence on all our lives, whether through disruption of global supply chains or threats of lockdowns in the face of soaring infection rates, was reasonably constant throughout 2021. However, it now appears that GDP numbers have become generally less sensitive to COVID infection rates than they were, say, 18 months ago, with high vaccination rates (certainly across developed markets), and an awareness from politicians that the public’s willingness to comply with lockdowns may be waning fast.