Asset Allocation – Page 37

-

News

NewsKENFO bets on cash, short-term bonds to withstand high inflation

It also gears portfolio strategically towards a balanced asset and risk structure to strengthen the ability to face crises

-

News

NewsPortfolio management moves beyond Excel

As the governance and disclosure obligations on pension funds increase, there is clear evidence of a diseconomy of scale

-

News

DACH roundup: SOKA-BAU to strengthen private equity, infra investments

Plus: Pensionsfonds increase contracts; Swiss largest firms cut pension liabilities

-

News

NewsPKA targets lower carbon by investing DKK5bn in ‘resource-efficient’ equity fund

Danish pension fund manager CIO says firm picked Osmosis IM as part of its new approach to ESG policy

-

News

PFZW unveils 50% carbon reduction target for 2030

The Dutch healthcare scheme has also for the first time formulated CO2 reduction targets for its real estate, infrastructure and private equity investments

-

Features

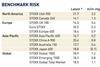

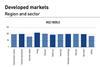

FeaturesQontigo Riskwatch - July/August 2022

* Data as of 31 May 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

-

Features

FeaturesIPE-Quest Expectations Indicator commentary August 2022

The war in Ukraine has reached stalemate. Neither party is capable of a surprise win, but time works against Russia. Can Zelensky keep the army motivated to continue? A long, hot European summer

-

Features

FeaturesAhead of the curve: solving the Russian share ban

Index investors inherently choose to follow the market through exchange-traded and index funds, but the recent prohibition on trading Russian stocks and their removal from global benchmarks has created something of a conundrum.

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Asset Class Reports

Asset Class ReportsCredit: Inflation and the bond markets

Risks look likely to be building in credit as central banks wreak collateral damage on economies in their bid to tame inflation

-

Interviews

InterviewsItaly's Previndai pension fund: On a journey to diversification

Alessandro Ciucci, CFO at Previndai, one of Italy’s largest pension funds, talks to Luigi Serenelli about its diversification strategy built on alternatives

-

News

NewsVervoer commits $300m to SDG-focused private credit fund

The ILX strategy will enable the scheme to access a diversified pool of investments across emerging markets

-

News

NewsUSS launches inaugural asset-backed securities mandate

Initial focus on investment grade and likely to exceed £1bn over the next couple of years

-

News

TAI releases open-source code for return-attribution method

Institute hopes framework will change investors’ thinking, shifting focus to fundamental drivers of returns

-

News

LGPS pushes for reporting consistency as pooling increases

Pooled vehicles now account for two thirds of local authority pension assets, according to the scheme’s latest annual report

-

News

NewsItalian pension schemes continue to trim bond investments

COVIP report shows investments in government bonds decreased from 37.3% to 35.5%

-

News

NewsSwiss pension funds record highest equity allocation in a decade

All asset classes have recorded negative returns except for alternative investments (0.8%)

-

News

Swiss BVK continues to engage on climate, social goals despite struggles

The fund supported the call of non-profit organisation Majority Action to replace Chevron’s CEO and lead director at its AGM