All articles by Carlo Svaluto Moreolo – Page 15

-

Interviews

InterviewsOn the Record: Lower yields

After the ECB’s announcement of more QE, we asked two pension funds how they plan to manage the prospect of lower yields

-

Special Report

Special ReportManagement & outsourcing: The rush is on

Competition is intensifying among providers of data analysis and benchmarking solutions

-

Opinion Pieces

Opinion PiecesChina’s human rights abuses pose challenges

Investors who are serious about ESG should ask themselves about their China strategies

-

Special Report

Special ReportCPPIB’s Asian quest

The largest Canadian pension fund already has a long track-record in the Asia-Pacific region but plans to grow its presence in the region

-

Special Report

China: Crazy rich Chinese

Investing in the rise of China’s middle class might seem obvious but it is a complex process

-

Special Report

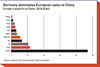

Special ReportHow fund managers view – and invest in – the rise of China’s middle class

Fund managers share their views on how China’s rising middle class is impacting the country’s economy and outlook

-

Special Report

Italy: Prioritising early retirement

The 2019 budget allocated funds to allow more favourable early retirement but its impact has been limited

-

Interviews

InterviewsOn the Record: Emerging markets

We asked two pension funds whether the distinction between emerging and developed markets still makes sense

-

Interviews

InterviewsHow we run our money: PGB

Harold Clijsen CIO of Dutch multi-sector Pensioenfonds PGB, speaks to Carlo Svaluto Moreolo about asset allocation, sustainable investment and member communications

-

News

Italian funds appoint Neuberger Berman to run joint private equity mandate

Five industry-wide defined contribution schemes have joined forces to invest €216m in private equity

-

Country Report

First pillar: Ahead of the game

Italy’s privatised first-pillar pension funds are modernising their strategies

-

Interviews

On the record: China

We asked two pension funds to tell us about the case for investing in China and their experience with investing in the country

-

Country Report

Country ReportCOVIP: The glass is half full

Despite its several ailments, the health of the Italian pension industry keeps improving

-

Interviews

InterviewsHow we run our money: Eni

Carlo di Gennaro, head of global group pensions at Eni, tells Carlo Svaluto Moreolo how the oil and gas company is streamlining its pension strategy

-

Country Report

Country ReportPrivate equity: Visions of the future

Is Project Iris, a joint effort by Italian pension funds to invest in alternatives, a sign of things to come?

-

Features

FeaturesItaly’s first-pillar obsession

Italy’s anti-establishment, eurosceptic coalition government has partly delivered on its promise to reform the pension system. ‘Dismantling’ the 2011 pension reform that curtailed benefits and raised the retirement age was key for both coalition partners – the Five Star Movement and the Lega. Previous governments had raised the retirement age.

-

News

NewsChart of the Week: Global passive assets hit €8.3trn

IPE’s Top 400 Asset Managers survey reveals extent of growth in interest in passive and index-based investing

-

News

NewsChart of the Week: Which asset managers have the most ESG analysts?

IPE’s Top 400 Asset Managers survey asked investment companies about their dedicated ESG and corporate governance specialists for the first time

-

News

NewsTop 400 Asset Managers: AUM grows 1% amid market volatility

BlackRock retains number one spot but six of top 10 managers reported a lower AUM figure than last year in IPE’s annual survey

-

Special Report

Special ReportChina: Befriending the dragon

Italy’s decision to join China’s Belt and Road Initiative has prompted criticism from the EU and the US