All articles by Carlo Svaluto Moreolo – Page 13

-

-

Special Report

Special ReportFactor investing: Crisis factor

What are the prospects for factor-based portfolios after the recent market crash?

-

Opinion Pieces

Opinion PiecesMarket disconnects have widened

Thanks to a remarkable comeback in April, equity markets have partly offset the collapse that took place as a result of the COVID-19 pandemic.

-

Interviews

InterviewsOn the record: Dispatches from the pandemic

IPE asked European pension funds how the COVID-19 outbreak has changed their lives

-

Interviews

InterviewsHow we run our money: Pensioenfonds KBC

Luc Vanbriel, CIO of Pensioenfonds KBC, tells Carlo Svaluto Moreolo how the Brussels-based fund is coping with the current crisis

-

Interviews

InterviewsHow we run our money: AP2

Lars Lindblom (pictured), global fixed-income manager at the second Swedish buffer fund, talks to Carlo Svaluto Moreolo about the fund’s evolving green bond investment strategy

-

Special Report

Special ReportStrategically Speaking: HSBC Global Asset Management

As the financial markets enter uncharted territory, HSBC GAM could be well placed to take advantage of the dislocations in Asian and emerging markets. Its aim, though, is to offer investors the full spectrum of fixed-income solutions, says Xavier Baraton, global CIO for fixed-income private debt and alternatives.

-

Interviews

InterviewsOn the record: Green bonds

IPE asked two Nordic pension funds how they invest in green bonds and to what extent sustainability is considered part of their fixed-income strategies

-

Opinion Pieces

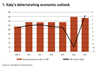

Opinion PiecesLetter from a country in crisis

Empty streets and squares are not a usual sight in Italy, a country whose people love to socialise. The deadly COVID-19 pandemic has even taught Italians to make orderly queues outside supermarkets. The reality is that while Italians are not good at prevention, they are outstanding at reacting to emergency situations, thanks to their experience dealing with earthquakes and other natural disasters.

-

Features

FeaturesFixed Income & Credit: Credit at a crossroads

How will weak lending standards hurt credit investors in a global slowdown?

-

Special Report

Special ReportPrivate and green: Non-listed sustainable debt

The market for non-listed debt with green or sustainability features is growing fast

-

Interviews

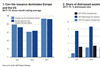

Strategically speaking: Old Mutual Alternative Investments

Africa looks set to account for over half of the world’s population growth between now and 2050, according to the UN. Thanks to a young population and a high fertility rate, Africa’s population could exceed 2bn, making it the fastest-growing continent in that respect.

-

Interviews

InterviewsOn the record: Asset manager selection

IPE asked the Caisse de prévoyance de l’État de Genève (CPEG) how manager selection is changing

-

Special Report

Special ReportRegulation: Asset managers - Regulators set sights on liquidity

Concerns about systemic risk and fund liquidity are driving the regulatory agenda

-

Special Report

Special ReportManager selection: When delivering value becomes law

The debate around the value added by asset managers is taking fundamental steps forward

-

Opinion Pieces

Opinion PiecesA belated but welcome debate

The belief that the corporate culture of an asset management organisation affects its performance is gaining ground. Some investment consultants make reference to corporate culture as a factor driving manager selection. This may be marketing, but it could spark debate.

-

News

NewsAon: factor investing overcrowding fears ‘not justified’

It is unrealistic to foresee a situation where factor premiums are wiped out completely

-

Interviews

InterviewsOn the Record: Absolute return strategies

IPE asked two European pension funds how they invest in absolute return strategies, with a focus on hedge funds

-

Opinion Pieces

Opinion PiecesTrustees should always protect pensions

The proposal to phase out the Retail Prices Index (RPI), one of the main measures of inflation in the UK is among the pension industry’s biggest topics of debate.

-

Special Report

Special ReportUK inflation: Collateral damage

Proposed changes to the measurement of UK inflation would have a significant impact on the DB pension industry