All articles by Carlo Svaluto Moreolo – Page 9

-

Interviews

InterviewsOn the record: Asset allocation

Three European pension funds discuss their outlook for 2021 and beyond, amid the uncertainty caused by inflation and a new strain of the coronavirus

-

Opinion Pieces

Opinion PiecesSolving the blended finance puzzle

It is hard to say whether Friedrich Nietzsche, one of history’s most influential thinkers, would have been a supporter of the United Nations’ Sustainable Development Goals (SDGs) and all that they entail.

-

Features

FeaturesPerspective - Blended finance: the ultimate impact investment

Calls for a greater role for blended finance expose the challenges and opportunities of public-private collaboration

-

Features

FeaturesBriefing - CLOs: a post-pandemic resurgence

Exactly a decade after the collapse of Lehman Brothers, the collateralised loan obligation (CLO) market was breaking records. In 2018, nearly $130bn (€113.6bn) worth of CLO paper was issued in the US and €45bn in Europe, a sign that the crisis of confidence caused by the Great Financial Crisis was over.

-

Opinion Pieces

Opinion PiecesNo right side to the inflation debate

The question of whether the current trend of rising inflation is a transitory or permanent one is not trivial. It is forcing the institutional investor community to reflect on their long-term investment strategies. Investors have to review their current approaches and get ready to make significant changes if their views prove incorrect.

-

Interviews

InterviewsOn the record: Social issues

Three European pension funds discuss their increasing focus on social factors within their ESG-driven investment strategies

-

Special Report

Special ReportPFA Pension: First interim target is ‘ambitious but realistic’

The pension provider is decarbonising its portfolio one asset class at a time

-

Special Report

Special ReportBorder to Coast: Climate solutions provider for the public sector

The asset pool has released a standalone climate-change policy to meet net zero

-

Special Report

Special ReportCarbon price: Dear greenhouse gases

Global carbon markets are expanding as prices increase, with consequences both for companies and their investors

-

Interviews

InterviewsHow we run our money: PKA

Michael Nellemann Pedersen, CIO at PKA, tells Carlo Svaluto Moreolo about the Danish pension provider’s investment philosophy

-

Features

FeaturesBriefing: Private market fees

In today’s low-interest-rate and low-return environment, investing in private markets has become a requirement for virtually every institutional investor. Private markets are where investors can obtain the extra returns they need and can no longer earn from listed assets, thanks to the liquidity premium and higher risk/return profile of non-listed assets.

-

Asset Class Reports

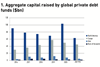

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

Opinion Pieces

Opinion PiecesPension funds should seek fee reductions in private markets

Pension fund investment in non-listed assets has grown considerably since the 2008 global financial crisis.

-

Interviews

InterviewsOn the record: Private markets

Three European pension funds discuss their views and strategies with regard to asset management fees, particularly in private markets

-

Special Report

Special ReportItaly: Reform season lies ahead

Italian policymakers are discussing further changes to the pension system but are reluctant to address the fundamental problems

-

Interviews

InterviewsOn the record: Aiming for carbon neutrality

Two Nordic pension funds discuss their ambitious climate transition strategies

-

Asset Class Reports

Asset Class ReportsInflation report – Pension funds riding the wave

As the outlook for inflation becomes increasingly cloudy, European institutional investors try to focus on long-term trends

-

Interviews

InterviewsHow we run our money: The People’s Pension

In a valedictory interview, Nico Aspinall, outgoing CIO of The People’s Pension, talks to Carlo Svaluto Moreolo about running one of UK’s largest occupational defined contribution pension schemes

-

News

NewsDenmark’s PFA decides first sub-target for 2050 net-zero goal

Pension company aiming for 29% reduction in carbon emissions stemming from its investee companies, assets

-

Interviews

InterviewsHow we run our money: Fondo Pensione Nazionale BCC CRA

Sergio Carfizzi (pictured), CEO of Italy’s Fondo Pensione Nazionale BCC CRA, tells Carlo Svaluto Moreolo about the fund’s ambitious alternative-investment programme