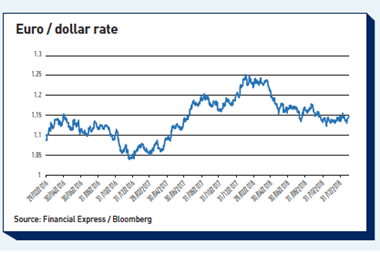

The Dutch pension fund for construction workers has raised its hedge of the US dollar following a 2.1% loss on its currency hedge in 2018.

In its annual report for 2018, BpfBouw said it had increased the dollar cover from 61% to 72%, in the wake of the currency unexpectedly appreciating relative to the euro.

The €61bn sector pension fund said it had kept an 80% hedged position on other strategic currencies, adding that it had fully hedged the currency risk on its hedge funds allocation but had not hedged its commodities exposure.

Earlier this week, the €18.5bn Dutch pension fund of electronics giant Philips reported a 2.4% loss for 2018 due to its full hedge of the currency risk relating to the dollar and the yen.

BpfBouw said it had stuck with its 45% interest rate hedge for its liabilities, which delivered a 1.1% gain last year as interest rates fell.

The industry-wide scheme reported a net result of 0.3% for its overall investment portfolio, largely due to the performance of its 18% allocation to property, which returned 12.5%.

BpfBouw’s real estate holdings are managed by Bouwinvest, its wholly owned property investor, while its remaining assets are managed by APG Asset Management.

Returns breakdown

In contrast to the property gains, the scheme posted an overall loss of 5.6% on equity, with developed and emerging markets losing 3.5% and 12.5%, respectively.

Developed market equity underperformance was chiefly driven by the pension fund’s quantitative investment strategy, BpfBouw said, following disappointing results from small and mid caps.

BpfBouw’s fixed income portfolio gained 0.9%, with credit gaining 2%. However, its emerging market debt exposure lost 1.9%, while inflation-linked bonds declined by 2.3%.

The pension fund said it had increased the number of green bonds in its portfolio by 39 to 141 – totalling €874m – last year.

Its infrastructure holdings in non-listed projects was the best performing asset class, returning 17.3% – although this only made up 0.3% of the scheme’s overall portfolio.

Private equity and hedge funds delivered 16.1% and 7.2%, respectively, while commodities lost 9.6% due to falling oil prices.

The construction scheme said that it had slightly adjusted its strategic allocation following an asset-liability management study, increasing its index-linked bonds allocation by 1 percentage point to 4.5%, and reducing its credit holdings to 18.5%.

Referring to ongoing discussions on Dutch pension reform, BpfBouw’s board said it still opposed the idea of individual pensions accrual as it preferred a pensions contract focusing on solidarity through a collective approach.

The sector scheme reported an administration cost per member of €97 and said it had spent 57bps and 13bps on asset management and transactions, respectively.

Based on a funding level of 118.3% at the end of the year, it granted members a 1% inflation uplift on 1 January 2019. However, indexation in arrears stood at 8.8% for active participants and more than 9% for deferred members and pensioners.

BpfBouw covers 783,000 workers and pensioners affiliated with more than 12,800 employers.