All IPE articles in December 2019 (Magazine) – Page 2

-

Country Report

Iceland: Brand new opportunities

Icelandic pension funds are being courted as a potential source of funds for infrastructure projects

-

Features

FeaturesBriefing: Peer-to-peer securities lending

The words scale, operational efficiency and lower cost feature regularly in the State Street discussion of its new peer-to-peer securities lending product. Direct Access Lending enables direct, principal loans between its lending clients and its borrowing clients.

-

Asset Class Reports

Asset Class ReportsLiquidity Solutions: Facing the illiquidity challenge

The deepening of capital markets should benefit investors in private equity

-

Opinion Pieces

Opinion PiecesLong-term matters: Financial sector employees can help win the climate change fight

More than a thousand Google employees have signed a public letter calling on the company to take bold action on climate change. They joined employees in other companies such as Amazon and Microsoft who published similar letters, calling their companies to take real action on climate change in response to the climate crisis.

-

Country Report

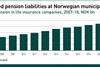

Norway: A civil revolution

The municipal pensions market is undergoing structural change as private providers are returning with new products

-

Features

ESG: UK regulator turns sights on climate disclosures

With environmental risks taking a more central role in investment strategies, regulators have also been looking at what actions they can take.

-

Special Report

What is next for the CMU?

As the new European Commission takes office, Europe’s pensions and investment sectors share their views on the priorities for the further development of the Capital Markets Union

-

Features

Corporate reporting: Where were the parents?

Financial reports are normally dull affairs. Apart from the endless reams of paper detailing figures that few people understand, most of us just want to know a few key facts: whether the bottom line profit number is higher or lower than last year; whether the overall balance sheet can be summed up with a correspondingly big number – big is always better; and, critically, whether there will be a dividend.

-

Interviews

How we run our money: Pension Danmark

Torben Möger Pedersen , CEO of PensionDanmark, tells Carlo Svaluto Moreolo that he sees the Danish pension provider as part of an improved Scandinavian welfare system

-

Special Report

Special ReportESG: A new dawn

How can private equity firms avoid suspicions of greenwashing as the industry embraces ESG?

-

Country Report

Denmark: A philanthropic fund

Lars Wallberg, chief executive of Velliv Association, describes how its unique structure brings advantages over conventional pension funds

-

Special Report

Interview: Trading on discontent

Christian Bluth is a trade economist at the Bertelsmann Stiftung, a German foundation and think tank. IPE’s Daniel Ben-Ami talked to him about the increasingly contentious topic of international trade

-

Country Report

Iceland: A dominant force

Pension funds dominate the Icelandic capital markets gobbling up opportunities

-

Features

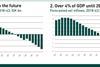

FeaturesResearch: Pension investors seem to be losing faith in quantitative easing

In the first of two articles on a new survey of pension plans, Pascal Blanqué and Amin Rajan find that unconventional monetary policy has taken a toll on pension funds

-

Opinion Pieces

The easy option

The Dutch social affairs’ minister Wouter Koolmees has spared millions of Dutch pensioners last month from having their pension payments cut in 2020, after the government granted pension funds a year’s grace period to restore coverage ratios.

-

Asset Class Reports

Asset Class ReportsPrivate Equity: Finding the right metric

It is hard to compare the performance of private equity investments

-

Country Report

Innovating in ESG through ETFs

Leading Nordic pension providers are teaming up with asset managers to design and launch ETFs that compliment and help achieve their ESG goals

-

Special Report

Europe: Has stability returned?

Despite the gloomy assessments there is a positive case for European capital markets

-

Features

Ongoing UCITS fees are falling

UCITS are an example of EU financial innovation and a global success story. With €10.1trn in total net assets, UCITS help global investors save for financial goals, including retirement, education, and housing.

-

Opinion Pieces

The fiscal shift is no solution

There is a growing consensus that there needs to be a shift from extraordinary monetary policy to fiscal activism. Although quantitative easing (QE) will continue, there is a widespread recognition that its effects are diminishing.

- Previous Page

- Page1

- Page2

- Page3

- Next Page