IPE's EU Coverage – Page 49

-

Asset Class Reports

European pharma under threat

Pharmaceuticals have long been the foundation of Europe’s industrial base. Now the sector must fight back against the threat of US biotech companies

-

Asset Class Reports

Sensitivity of selected European equity funds to macro factors

The data shows the sensitivity of European equity funds to changes in a selection of macroeconomic factors: European default spreads, European term spreads, European interest rates and European inflation.

-

Asset Class Reports

Asset Class ReportsEuro-zone sovereign bonds: A parallel world

Regulation continues to push European pension funds to invest in euro-zone government debt at increasingly unattractive yields

-

Special Report

Two cheers for the euro-zone

January’s announcement by the ECB of its bond purchase programme has been followed by good numbers

-

Asset Class Reports

Grexit and euro-zone ratings

Greece’s exit from the EU could cause other countries to follow, and ultimately lead to the destruction of monetary union

-

Special Report

Special ReportEuro-zone recovery: Catching a tailwind

Euro-zone assets have generally performed well in recent years, but there are some substantial hurdles if their growth is to be sustained

-

Special Report

The unique case of Greece

The tribulations of recent years have turned Greece into a unique case within the euro-zone

-

Asset Class Reports

Euro-zone sovereign bonds: State of the nations

QE helps but only reform can resolve the euro-zone’s problems, according to David Zahn

-

Special Report

Special ReportELTIFs: Kick-starting Europe's economic growth

European Long-Term Investment Funds are designed to help kick-start economic growth by broadening the range of investors in infrastructure and research projects

-

Special Report

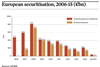

Special ReportRegulatory environment still weighted against Europe's ABS market

The European market for asset-backed securities has ample potential but suffers as a result of an unfavourable regulatory regime

-

Special Report

Euro-zone recovery: Insurance and repression

European insurers are finding ways to adapt to the prolonged period of low interest rates and unconventional monetary policy

-

Special Report

Euro-zone recovery: SME Lending – Affairs of credit

Everyone wants to secure funding for small businesses, which has led to initiatives across Europe designed to take up lending slack where banks have pulled back

-

Asset Class Reports

Cheap oil and weak euro: Impact on European equities

Joseph Mariathasan considers the likely effects of dramatically cheaper oil and a weak euro on European earnings and equity market prices

-

Asset Class Reports

European equities: The stock-pickers return

How can European equity portfolio managers find genuinely idiosyncratic stock risk amid the current top-down noise?

-

Asset Class Reports

European equities: Recovery or retrenchment?

Martin Steward finds European equity managers disagreeing on how to position for the business cycle

-

Asset Class Reports

European Equities: What is Europe, exactly?

Investing in European equities sounds like a straightforward task. But as investors finally begin to look upon the region more favourably, Joseph Mariathasan finds that ‘investing in Europe’ can mean many different things

-

Asset Class Reports

European Equities: Transition management

As the market-leading stocks and sectors begin to rotate, Martin Steward finds the top manager positions occupied by those value managers that have maintained pace with their quality peers over the past three years

-

Special Report

The Euro-Zone: A rising tide

A flood of global liquidity is floating all of the euro-zone’s boats – even those, like the Netherlands and France, whose economies have taken a turn for the worse. Lynn Strongin Dodds looks at the dynamics

-

Special Report

The Euro-Zone: Understanding sovereign spreads

Lorenzo Naranjo and Carmen Stefanescu argue that European sovereign spreads are all about the flight to liquidity, not the flight to quality

-

Special Report

The Euro-Zone: The Cyprus syndrome

Helen Fowler finds the risk-reward balance across European bank debt changing rapidly following recent resolutions