All IPE articles in July/August 2019 (magazine)

View all stories from this issue.

-

Features

IAS 19: How did they do it?

Two academics have analysed key amendments to IAS 19 and how they came about

-

-

-

-

-

Features

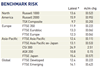

FeaturesIPE Quest Expectations Indicator: July 2019

Markets are still driven by political risk and growth prospects. It looks like the two risks are working in the same direction this month.

-

Features

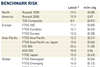

FeaturesIPE Quest Expectations Indicator: August 2019

It looks like political risk is taking a back seat to growth this month, continuing last month’s trend.

-

Features

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

Special Report

Special ReportInvestment services: Accessing China's bond market

Access to China’s fixed-income market is cheaper and easier than ever

-

Book Review

Book ReviewBook review: Achieving Investment Excellence

Fix asset allocation and the numbers will follow. This rule of thumb originated from an influential study published in 1986, which showed that 93.6% of variations in a portfolio’s returns are due to asset allocation policy.

-

Features

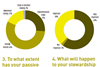

FeaturesResearch: Passive investors, active owners

The rise of index investing raises important question about ownership rights and governance

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Adam Matthews and John Howchin

“The Brumadinho dam tragedy causes us to question if we have created the conditions for a set of disasters”

-

Features

FeaturesAdequacy: the all-important question

How do you measure success when it comes to pension reform? In the UK, it is clear that the government measures the success of auto-enrolment by some numbers, but not others.

-

Country Report

Country ReportIORP II: Race to adopt new rules

Putting the new IORP II rules in place will be a challenge for Italian pension funds in areas like risk management

-

Features

FeaturesDutch pensions agreement dodges the real issues

Social partners have agreed compromises relating to the state pension age and early retirement Many crucial aspects are yet to be confirmed and could still derail efforts to reform the system

-

Features

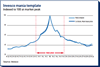

FeaturesAhead of the curve: The bubbles to come

Market bubbles would not happen in a perfect world. But humans are not perfect and our economies are inherently unstable.

-

Country Report

First pillar: Ahead of the game

Italy’s privatised first-pillar pension funds are modernising their strategies

-

Country Report

Country ReportA real alternative to help Italy's economy

A review of think tank Itinerari Previdenziali’s and Borsa Italiana’s recent project on Italian pension funds’ real-economy investments

-

Features

Editor's Notes: A radical ambition

Last month’s three doorstop reports from the EU’s 35-strong technical expert group (TEG) on sustainable finance have the potential to radically repurpose capital markets.

-

Opinion Pieces

Opinion PiecesAnimal welfare: Probing the global meat complex

Everyone knows about ‘big oil’ and how much influence the global agribusiness sector has. But there is less awareness about the negative impacts of meat producers – the ‘global meat complex’.